Budgets, budgets, budgets. We hear constantly about how a budget is the bread and butter of finance. To achieve your financial goals, be it to retire early, achieve financial independence, begin investing, save for a retirement fund, pay down debt, or any of the other multitudes of financial goals, you have to know what’s coming in and what’s going out.

Pretty simple, huh?

Well, yeah, if you have a 9-5 it’s a breeze. An hourly wage or a secured salary makes it pretty easy to calculate how much you’re earning because your income is, for all intensive purposes, consistent.

But what if your income stream isn’t consistent? Freelancers, bloggers, business owners, those with side hustles,and those who are self-employed all may encounter streams of inconsistent income.

So, how do you make a budget when you’re never really sure exactly how much is coming in every month?

That’s exactly the situation Stefanie O’Connell has always found herself in.

Stefanie O’Connell is a financial expert and blogger at stefanieoconnell.com. She is also the author of the personal finance book The Broke and Beautiful Life. From starting out her career as an actress to evolving into the self-employed personal finance guru she is today, Stefanie has never known how much she is going to make in a given year.

Luckily, a lifetime full of inconsistent income has helped Stefanie devise her own strategies and tools to use when budgeting specifically for inconsistent income. Even luckier for us, she’s shared her budget strategies with us so we can guide you through the process of building a budget, no matter what your source of income is.

Where To Start

Find a Reference Point: you have to find this, and it needs to be down to the dollar and not just an educated guess. Especially when you’re making inconsistent income, you need to know what your cost of living is.

How do you do this?

- Track your spending: Know exactly what is going out each month, and how much you’re spending on what. This gives you an idea of what your cost of living is.

-

- Use spreadsheets to track each expense, or use an app like Mint or Level Money for convenient automated tracking of every purchase.

- Ground yourself in those numbers: Analyze what is out of alignment purchase-wise. Do you need to cut living expenses? Maybe you’re spending tons of money on coffee every morning, or maybe your cable bill is eating you alive. Confronting your spending is one of those things that’s really easy to become an “out of sight, out of mind” situation, but forcing yourself to take a look at your expenses can help you identify easy savings opportunities and begin slowly curbing extraneous spending.

Once you have a good idea of what’s going out, this brings us to our first step: figuring out what’s coming in.

Step 1

Use Last Month’s Income:

This really is the key to budgeting when you have inconsistent income because it provides the most accurate, numbers based reference point for what’s coming in when budgeting with variable income. Use what you made last month and budget for that number/range for the upcoming month. This gives you the most accurate range to start with.

Action Tip: Try going back 3-6 months and find an average monthly earning value or a range to use when creating your budget. Even if your income is inconsistent, it’s still important to ground your budget in real numbers.

Step 2

Find Your Make Or Break Number

This next step is important because it helps you calculate the absolute minimum you must make in a month to cover your lifestyle needs. This is a step Stefanie advocates regularly on her own blog.

This is the absolute

“monthly minimum, no frills cost of running your life.”

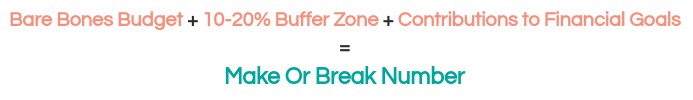

Finding your make or break number requires 3 calculations first:

- Find Your Bare Bones Budget

⟶ This number includes all living necessities (rent, utilities, food, insurance & anything critical to the normal functioning of your work and lifestyle).

↳ Include irregular expenses such a quarterly insurance payments etc (find monthly value for those payments and budget that in)

⟶ Excludes beauty, entertainment, personal purchases, dinners out etc

- Add A Buffer Zone

⟶ Life is always more expensive than anticipated, so adding a buffer zone is a safety measure that helps pad your budget in case you underestimate how much you’ll need for a particular expense. Stefanie recommends adding a buffer zone that is 10-20% of your bare bones budget.

- Determine Financial Goals

⟶ Don’t choose between paying off debt and paying rent. Having an emergency fund is so important, particularly for those making inconsistent income because it’s what will get you through if you have a bad month. Include your financial goals like debt repayments, retirement contributions, or emergency fund savings in your make or break number, this way you’re never compromising your ability to contribute to financial goals.

So:

Once you’ve got your make or break number, you know that this is the absolute minimum you have to earn to cover your lifestyle necessities. This can also be known as your nondiscretionary expenses (what you have to have).

If you find that your make or break number feels too high, you can take a look at your expenditures again. Are there any costs you can cut? Can you consider cheaper transportation, call to negotiate for cheaper insurance premiums, or look into cheaper housing options?

Step 3

Find What’s Left

To calculate what’s left over after funding your necessities:

Use last month’s income (or whatever value you used as your income reference point) and subtract that make or break number you found in step 2. This is the amount left over that can be split between discretionary purchases (eating out, entertainment, social, personal care), or more financial goals for the upcoming month that you are budgeting for.

Find Structure With Zero Sum Budgeting

Finding a budget that works with both your lifestyle and an inconsistent income stream can be trial and error. Being flexible and cautious, and also be open to making adjustments can help. Of course, an openness to letting your budget evolve is beneficial and having flexibility in categories can be helpful. That’s why the above strategy of using last month’s income, finding your make or break number and then designating the remainder for discretionary expenses is helpful for those who like having a little freedom and wiggle room within a budget.

However, if that much flexibility is making the super organizer in you cringe, you need to find a way to add more structure into your budget.

That’s where Zero Sum Budgeting comes in.

Zero Sum Budgeting uses the same basic principle of finding a make or break number and using last month’s income as a reference point to plan for the following month’s expenses. The difference is instead of just splitting the left-over income, after subtracting your make or break number, between discretionary and financial categories, Zero Sum Budgeting assigns a dollar value to every single category. This means that every single dollar you make is designated a rightful purpose.

To use it:

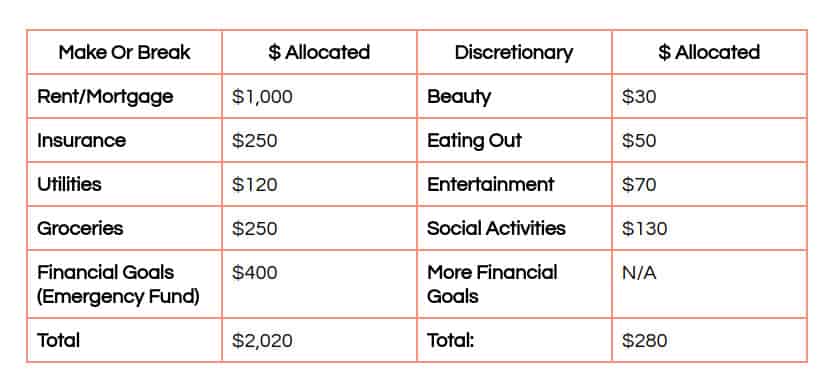

- Use the same process to find your make or break number and left-over income as shown in Steps 1-3.

- Write down each subcategory that money will be allocated towards. Define subcategories for both your make or break expenses (like rent, insurance, utilities, food, financial goals etc.) as well as for discretionary expenses (like entertainment, dinners out, social events, beauty, fitness, health, home, etc.).

- Take your income and allocate an expense value to each category until you reach zero, with every dollar accounted for.

For example:

Let’s say your net income last month was $2,300. You calculate your bare bones budget to find your make or break number is $2,020.

(Last Month’s Income) $2,300 – (Make Or Break Number) $2,020 = $280 Leftover

ULTIMATE TOTAL: $2,300

Zero sum budgeting “maps out a destination for each and every dollar…that way you're not having any guess work of saying, “Oh, can I really afford to do this?” You know immediately, because you've already planned for it. You said, “Well, I have a $100 for this occasion and here is how I'm going to make it work within that $100 framework,” rather than saying, “Oh, I'm going to go to this thing and see how it goes.”

Zero Sum Budgeting is just a way to add more structure into your budget. Hit your allocated limit in a category and you’re done with it for the month.

All in all, budgeting with inconsistent income is completely doable. Be adaptable, track all of your expenses, find your make or break number, and give yourself structure where you need it.

If your make or break number feels too high or doesn’t give you as much left-over as you would like, try and find ways to reduce costs. Or, better yet, work to diversify our income streams.

This is a pro-tip for everyone, but it’s especially beneficial for those of us who have inconsistent income. Having multiple sources of income, like a side hustle, not only pads us with some extra cash flow, but also allows us to have financial flexibility in case something happens to one of our income streams.

Look for ways to diversify your income stream and if you’re looking for a little inspiration, check out our post dedicated solely to finding your perfect side hustle!