Post 1 Of 3

This post is post number 1 of a 3 part series on how to reach financial independence – the Step By Step Plan To Early Retirement..How This Guy Did It In Under 10 Years

Part 1: Current Post

Part 2: Copy These Trips: How To Travel For Free Using Travel Hacking

Part 3: How To Launch A Side Business To Earn More Income & Retire Faster

What if you could retire early and cover your annual expenses each year without having to work again?

That's the core idea behind financial independence.

Meet Justin McCurry, financially independent early retiree and blogger at rootofgood.com

Justin has managed to accumulate enough wealth to become financially independent and retire by age 33. That's after just 10 years of working.

How did he do it?

He saved a large proportion of his and his wife’s earnings, and invested their assets wisely.

No winning lottery ticket, no rich uncles and no trust funds. Anything he did, you can do too.

Both Justin and his wife had regular 9 to 5 jobs. Over the 10 year period, they made just over $100,000 combined.

They developed a financial plan that allowed them to live on a portion of their income. They then invested the rest of their savings into their 401k’s, IRAs, and regular brokerage accounts that gave them a solid average return of 7% annually.

Do the words 401k, IRA and brokerage accounts make you want to cringe ?

Don’t worry, Today I’m going to break these down in plain English. I'll also outline the 3.5 steps involved to reaching financial independence.

But first…

What Is Financial Independence?

Financial independence in a nut shell is a pretty broad term.

In the personal finance world it means covering your living expenses using a passive income stream.

There are three passive income streams that Justin outlined:

- Real estate

- Businesses that run themselves

- Investment portfolio of stocks and bonds

Financial independence is when you get to the point where your investments create enough income to support yourself indefinitely.

Today we will be outlining Justin's approach to reaching financial independence. Living off the interest of an investment portfolio.

So let’s get to it.

The 3.5 Steps To Financial Independence

Step 1: Determine Your Magic Number

Your magic number is the number you need saved for your investments to generate enough income to support you without working.

The general rule of thumb when coming up with your magic number is to use a 4% safe withdrawal rate. That's the amount of money you can withdraw each year in order to safely live off your investment for the duration of your retirement.

The formula looks like this:

Let's say that to cover you (or you and your households) annual expenses you need $40,000.

You would multiply $40,000 X 25 to get your magic number.

$40,000 X 25 = $1,000,000.

This formula is generally seen as a safe formula to use to plan for a retirement of 30 years or so.

But what if you want to take the path to early retirement like Justin?

You may need your investment to last 50, 60 or even more years.

Justin recommends changing your safe withdrawal rate to about 3.3%

In this case the formula would be:

This would increase your magic number.

At a safe withdrawal rate of 3.3% you'd need $1,200,000 to retire early.

$40,000 x 30 (100 / 3.3) = $1,200,000

Make sense?

To figure out your magic number, take your annual expenses and multiply it by either 25 or 30, depending on the length of your planned retirement.

If you're wondering how you're going to actually earn that amount of money, we'll talk about that in Step 2.

Step 2: Identify Your Savings Rate

Your saving rate is the most important contributing factor to the speed at which you’ll reach your magic number. Remember your magic number, is the amount you need, to retire financially independent.

Your saving rate is determined by two things:

- How much money you take home every year

- Your annual expenses

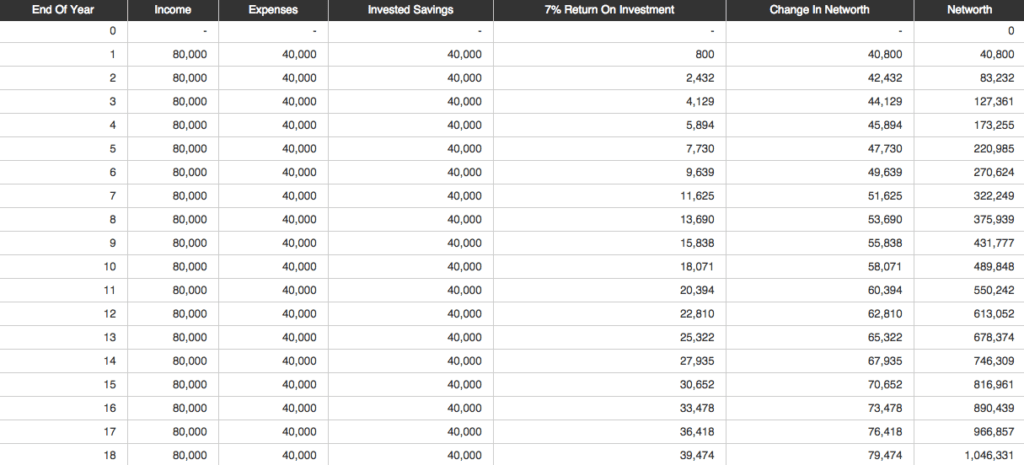

If you’re making $80,000 a year (after taxes), and your annual expenses are $40,000 then you’re saving $40,000 or 50% of your take home pay.

At a savings rate of 50%…it will take you 17 years to reach your magic number ($1,000,000).

[thrive_2step id='8519′] [/thrive_2step]

[/thrive_2step]

Let’s go through another example:

If your take home pay is $150,000 a year, and your annual expenses are $90,000 then you’re saving $60,000 a year. That’s a savings rate of 40%. Still higher than the average family.

Want to guess how long it’s going to take person B to retire?

Over 21 years.

Person B is saving $20,000 more than person A. But their annual expenses are higher and they need to work an extra 4 years over person A.

Your savings rate has more of an impact on your speed to retirement than increasing your income does.

If you earned $200,000 (after taxes), and you having a saving rate of 50% it will still take you 17 years to retire even though you are making more money.

This is because your saving rate stayed the same, but your expenses are higher.

Justin explains, the reason is that every drop in your spending has a double effect:

- It increases the amount of money you have left over to save each month

- It permanently decreases the amount you’ll need every month for the rest of your life.

If you get a raise but immediately spend it, you won't reach retirement faster, you will delay it.

What if you want to retire in 10 years, like Justin?

You need to be living on 35% of your take home pay. And saving 65%.

Did you just have a knee jerk reaction?

Maybe you're thinking:

“You're crazy Brittany, how can I save 65% of my take home income”

Fair question.

If 65% savings sounds like a lot to you, that's because it is.

The average American (and probably Canadian for that matter) saves 5% a year.

At that rate, it would take you 67 years to retire.

67 years is a long time. Too long.

If you don't want to be working for the next several decades, here's a reality check: changes need to be made.

[thrive_2step id='8520′][sc:retirefaster ][/thrive_2step]

First, don't think about how it's not possible, think about how can you make it happen.

Justin is an example of how this is possible.

Justin has a nice house, two cars and just about every year still managed to go on a great vacation with his wife and kids while saving.

He didn't think, this is impossible, I'm doomed to work forever. He got creative with his money.

Instead of using cash to book his family trips he utilized travel hacking to get the trip free by collecting and redeeming air miles.

Second, and this is important – in theory YOUR earning potential is limitless.

You have two options to reach retirement in 10 years.

- Option A: Reduce your existing living expenses and increase your saving rate to 65% of your take home pay.

- Option B: Increase the amount of income you make so that at a saving rate of 65% you’re able to live on 35% of your income very happily.

Option A: Reducing your expenses and getting creative with your money is an important skill to learn. But I don't believe in being so frugal that you aren't enjoying your current life.

That's why I created the phrase Luxurious Frugality. This is the practice of reducing your expenses without significantly changing your lifestyle.

A great example of luxurious frugality is travel hacking. Instead of using your cash to travel, you use air miles.

Here I am skydiving in New Zealand. Travel is not something I'd want to give up.

Using luxurious frugality is a great way to align yourself with Option A.

Now with that said, most personal finance blogs tend to focus on Option A and Option A only.

I tend to focus more on Option B.

In the Option B scenario you would increase your income so that living on 35% of your take home pay doesn’t significantly change your lifestyle.

Side note: I have many side businesses that earn me passive income. This was another method to financial independence that Justin mentioned earlier.

I will cover this in a future post. I firmly believe everyone should have a side business, even if you never plan on leaving your 9-5 job. This is a way to diversify your income stream. Jobs disappear, life happens.

For now start by identifying your goal saving rate that you'll work towards.

Step 2.5 : Shrink Your Pay Check

This technically falls under the category of saving money, but it's important enough to have it's own step.

Taxes. Just writing the word makes me want to cry.

You work hard to earn your money, and then poof a huge portion of your income is gone before you ever see it.

Unless you're Justin…

The lower you can legally keep your taxes, the more of your income you can take home.

In one year Justin managed to reduce his taxes to just $150 on a combined income of $150,000.

Whhhhaaa?? Say that again.

$150 in taxes on $150,000 of combined income.

That’s tens of thousands of dollars of extra take home money that Justin was able to keep.

He managed to keep his tax rate so low because of these two factors:

- Taking advantage of all available tax deferred savings options

- Having kids

He didn’t use any clever or unique tax dodges or questionable tax treatment. Justin and his wife simply did the research and put a plan in place to decrease their taxes.

I don't have kids, but I'm still able to take advantage of many of the tax strategies he used.

Here are a few of them:

- Retirement plan contributions (401k, 457)

- Pension contributions

- Employee stock purchase plans

- Employee stock ownership plans

- Health saving insurance (HSA)

- Dental insurance

- IRAs

Here's an example.

Every year Justin and his wife maxed out their 401k accounts contributing $17,500 each. This lowered their taxable income. The lower the taxable income, the less tax they pay.

As an example on a $70,000 income, as a single earner with non deductions..you'd have a U.S federal tax bill of $11,719.

But if we max out your 401k and contribute $17,500…your taxable income drops to $52,500 and your tax bill drops all the way down to $7,344 – saving you $4,375.

Saving $4,375 extra every year would cut years and years off of your retirement date.

Add a few more strategies and that's how Justin managed to bring his taxable income down and end up with a tax bill of just $150.

[thrive_2step id='8520′][sc:fullinterview ][/thrive_2step]

Step 4: Your Savings, Invested

So far we’ve:

- Talked about identifying your magic number

- How to identify your goal saving rate

- Discussed several ways to shrink your pay check

Now what do you do with your savings so they can achieve a 7,8 or 9% return on that money (as averaged over time)?

Your savings are no good sitting in the bank earning 1% percent. That’s not even enough to keep up with inflation (on average about 3% a year).

You need compound interest on your side. For those just starting out with investing Justin recommends looking at ETFs.

ETF stands for exchange traded funds. They act like a mutual fund but trade like an individual stock.

Like a mutual fund, one ETF can hold hundreds or sometimes thousands of individual stocks and bonds. This helps spread out your risk.

You don’t need to keep track of every single investment, the fund is managed by fund experts who do that for you.

ETFs have a much lower cost (expense ratio) than mutual funds.

Expense Ratio is one area that Justin advises you pay close attention to when looking at the cost of your investments.

An actively managed mutual fund or money manager will charge you 1 to 2% of your investment each year. This is much higher than an ETF which ranges from .013 – .5% expense on average.

A higher expense ratio can add up to hundreds of thousands of dollars in extra cost over time and adding several years to your retirement date.

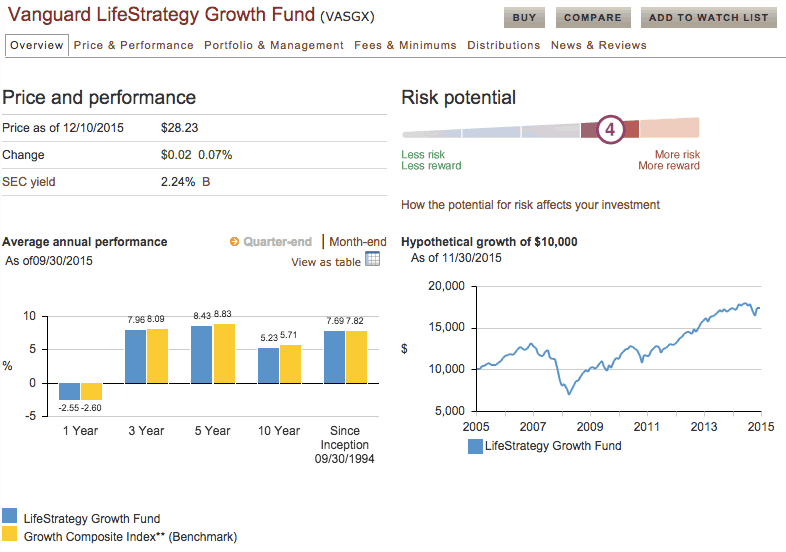

There are many companies that have ETFs but Vanguard is the one Justin recommends.

Start by looking at the LifeStrategy Growth Plans. These are a mix of stocks, bonds and international stocks that you’d want in your portfolio. Instead of buying many ETFs, they are bundled in one fund.

Think of it as a lazy investment approach that still gives solid returns.

Since the start of the Vanguard Lifestrategy Growth fund it's had a 7.69 % return overall.

Pretty solid.

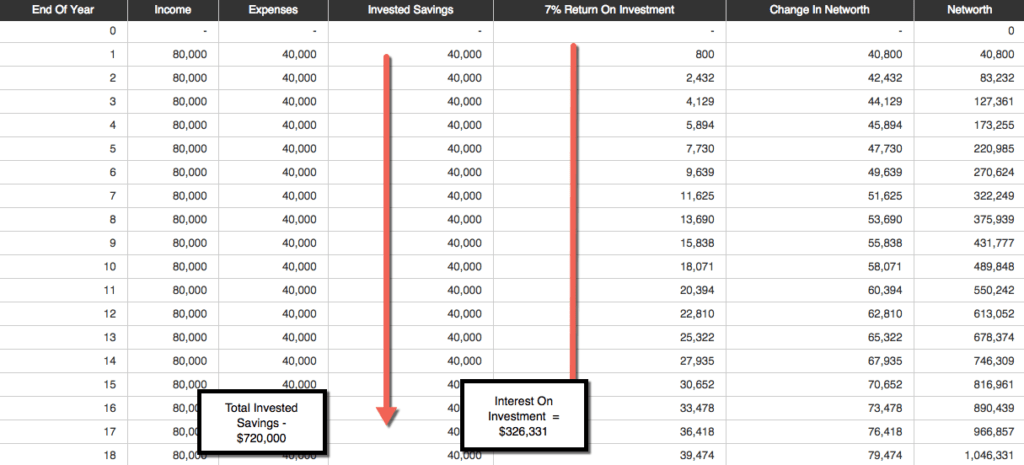

Just to put it in perspective a 7% return on your investments each year, based on $80,000 salary and $40,000 in savings annually example we used above means that over time you earn an additional $326,331 on your invested savings.

That's the power of compound interest.

That's a lot better then letting your cash sit in the bank.

There are different lifestrategy funds that you can get, based on your risk tolerance.

As you develop more knowledge on investments and want to try and increase your return you can take a 3 fund portfolio apporach.

Justin suggests starting with three asset classes:

- Total US Market

- Total International Market

- Total Bond Market

Vangaurd has an ETF that represents each of these asset classes. These would be good corner stone ETFs to have in your portfolio.

Justin has ten different asset classses in his portfolio.

Get Justins‘ Full Interview Here & Learn More About Early Retirement & Investing

Okay so there we have it..

4 Steps To Creating Your Path To Financial Independence.

Start by identifying your magic number. Then create a goal-saving rate. Spend some time researching how you can shrink your paycheck. Finally, make an investment strategy with a goal of at least a 7% (average annual) ROI.

Did you enjoy this post? Comment Below

Financial Disclaimer: This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.

tim

December 12, 2015Nice post Brittany. I don’t think enough people look into the financial growth strategies soon enough. It takes a discipline to save and the proper knowledge to invest, which most are not willing to overcome to achieve those results. Nice to see your back.

Jay

December 12, 2015I have to say Brittany I’m under an avalanche of emails these days and your email on this topic had me at “Retire Early”. Then the content really delivered some great info. I love the specific recommendations on ETFs. My portfolio has a mix of funds and ETFs and I’ve heard good things about Vanguard so I’m going to checkout the ones mentioned. Also, love the travel hacking tie-in. Every year I take adventure trips to faraway places and have been all over Asia, explored the Amazon, and gone camping in Africa on safari. But, even though I’ve also flown first class on miles many times the guy you referenced looks like the Yoda of travel hacking so I’ve got to see how he does it to get an edge up on my next trip.

-Jay

Chris

December 15, 2015Brittany,

How about a link to Justin’s site? It seems odd to me that you draw so much info from what he’s doing and what’s on his site that you don’t even give him a link back?

Show some love!

Otherwise, great article!

Brittany

December 15, 2015His website was/is listed in the first few sentences of the article 🙂 His site has some great info, including a breakdown of his earnings and results over the ten year period.