Own My Most Valued Collection Of Interview Transcripts, Notes And Instant Action Worksheets… Everything I’ve Used On My Path To Financial Independence

You need to go to school. Study hard. Attend the right University. Get the right job. Work hard. Buy a house. Get promoted. Work even harder. Buy a bigger house.

Lather, rinse, repeat… for 30 years.

Then – if you’re lucky – you can retire on a golf course at 65. And maybe – if your joints aren’t too sore – you might get to enjoy a few years of freedom before you die.

But… what if there was another way?

What if you could make minor shifts to the way you approach your life… and achieve that state of financial freedom much, much earlier?

That’s what I want to share with you today.[/text_block]

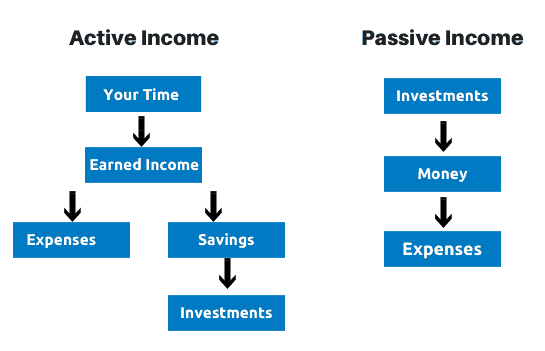

The Passive Income Principle

It’s a difficult cycle to escape… if you don’t know how.[/text_block]

Trading Your Time For Money (Active Income) Versus Financial Independence (Passive Income)

[/text_block]

But What Does Financial Independence Actually Mean?

It’s that point at which you’re able to retire, without needing to work again.

What you might not realize is that… there are multiple ways to achieve that goal.

Those might include:[/text_block]

Your Investment Portfolio

[/text_block]

Real Estate Income

[/text_block]

A Side Business That Runs Itself

[/text_block]

And More…We'll Cover This In A Minute

[/text_block]

And don’t worry if you don’t have a plan yet.[/text_block]

It’s Not Too Late To Start

If you’re in that situation – you might be feeling anxious. I understand.

It’s very scary to have an unsure financial future.

You might be wondering if it’s still possible to turn things around, and achieve financial independence in your lifetime.

The good news is I know that it’s absolutely possible.

The four percent club is designed to help you no matter what your situation:[/text_block]

No Savings (And In Many Cases Debt)

[/text_block]

A Regular Salary

[/text_block]

Never Made A Budget Before

[/text_block]

Choose Your Retirement Date

But what if you don’t wait that long?

Or what if you don’t have 67 working years left?

Most financial gurus would tell you that you have ONE option… save more.

I don’t focus on just one option…I give you 5 options and areas to help you reach financial independence & retirement faster.

Before I reveal those 5 methods…[/text_block]

Let’s Look At The Math For Someone Earning $60,000 Per Year

That’s a long time. Let’s see if we can speed things up.

Let’s say every year you spend $3k per year on a two week vacation.

My friend Scott who has figured out how to fly first class for free to any destination in the world using points and miles. He can also get 5 star hotels for 1 star prices.

If you use his techniques, you save the $3,000… but you don’t miss out on the vacation. In fact – you’re probably travelling in far more luxurious conditions than before.

Except now you’re saving $6k, or 10% of your income…

That means you can retire in just 51.4 years.

Yikes. That’s still a long time…

But, you’ve just saved yourself 14.4 years of work.

Now imagine you’ve added a side hustle – an easy to start side business that generates mostly passive income. Drop shipping physical products on Shopify, for example.

My friend Boris makes over a $1,000,000 per year with the one hour drop shipping formula. But let’s be EXTREMELY conservative and say that in your first year, you make 10k…

That’s 0.001% of what Boris is making…

Your savings rate shoots up to 22%, while your lifestyle remains the same. And instead of waiting 51.4 years to retire… you can retire in just 34.7 years.

You’ve just saved an additional 16.7 years of work.

Okay – but what about your taxes? Even the word used to make me want to cry.

What if we can take what used to be a dreaded time of the year, and use it to our advantage to retire even faster? 100% legally and ethically.

For example – on $70,000 in income, as a single earner with no deductions… you’d have a U.S. Federal tax bill of $11,719.

If we max out your 401k contribution at $17,500… your taxable income drops to $52,500 and your tax bill drops all the way to $7,344 – saving you $4,375.

When you save all of that – your total savings spikes to $20,375.

Your savings rate is now at 30% of your income – with no lifestyle changes.

You’ve just cut your time to retirement by more than half.

I know that seems over simplified, but little tweaks make a HUGE difference.

And…

That’s only by using a handful of the tools available to you in the four percent club.

Every situation is different. Maybe you’re not starting at zero and already have some savings, or have a higher or lower annual salary, or a different overall saving rate. All of those factors will affect your “retire by” number.

I made these calculations using my Early Retirement Calculator – which I’ll tell you more about in a minute, but first I want to point out that…

The goal of the four percent club is to give you all the resources, tools and information you need to reach your financial goals…from people who have done it before!

With them you decide when you want to achieve financial independence. You can do it in 20 years or 15 years or even 10 years – even faster, depending on where you’re starting out – without flipping your lifestyle on its head.[/text_block]

Take A Sneak Peek..

While I did come up with some of these ideas on my own, I am by no means an expert on everything…far from it.

That’s’ why I sought out advice along the way from some of the brightest experts in the world.

Experts that have been featured on sites like….[/text_block]

It’s because of them that I founded the 4% club….

I wanted a place where I could collect the best ideas from the top experts on topics like creative saving, luxurious frugality, alternative businesses and investment.

Ideas that will help you achieve Financial Independence & retirement faster…

And without sacrificing your lifestyle today.[/text_block]

Introducing The 4% Club…

The 5 Pillars To Financial Independence & Early Retirement

One: Getting To Financial Zero

Before you can get your money working for you, it’s critical that you stop it from working against you. This is really the first step on the road to independence. Whether it’s…

[/text_block]

We’ll speak to experts who know how to do it faster and smarter. Like Justin from Root of Good who retired at 33 years old despite a combined family income that averaged $100,000 per year or less.

And we’ll share concepts like the SafeMax 4% retirement rule… which tells you the exact percentage of your retirement fund you can withdraw per year to never run out.[/text_block]

Two: Luxurious Frugality

You might think financial responsibility means sacrifice. Or That you can’t have nice things, and fun experiences today while preparing for tomorrow.

I don’t believe that has to be the case.

I believe you can enjoy life while investing in the future.

Take Scott for example. He’s one of the experts I interviewed recently. His claim to fame is that he’s travelled to 65 countries by 28 – flying practically for free.

This life hack lets him have multiple “dream vacations” per year… for pennies on the dollar. That means he can save money while exploring the world.

With our Luxurious Frugality interviews we’ll be talking to other experts like him – who specialize in living a caviar and champagne lifestyle on a ramen noodles budget.

So you can put more money to work, without having to suffer for it.[/text_block]

Three: The Power Of Side Businesses

Or perhaps you’ve never thought of yourself as an entrepreneur.

If that’s the case. That’s okay – most people don’t. One of the main reasons why is that starting a business can be scary.

Especially if you’ve got a good job with security…

Why would you start over from scratch with all the risk?

That’s why I’m big on side income. These are ways to generate passive income, without quitting your day job (unless that’s your goal). Ways to earn extra money, as a hobby.

But – just because it’s a side hustle doesn’t mean it can’t be very profitable.

Take my good friend Aman whose interview is waiting for you to download in the members area. He rents houses long term, then rents them back out on AirBnB short term – collecting the profit for himself.

He rents one unit in Los Angeles at a cost of $3,500 per month. Then he flips it on AirBnB for $320 a night, with an average occupancy rate of 85%…

Bringing in $8,160 per month.

After expenses, he’s making roughly $4,660 a month or $55,920 per year.

That’s on one property. Collectively he has 6, and counting.

And AirBnB is just one side business. You’ll also hear many other strategies from the other interviews and video trainings in the members area like:[/text_block]

Digital Publishing Like I Do

[/text_block]

Freelancing Like My Friend Vic

[/text_block]

Drop Shipping Like My Friend Boris

[/text_block]

Four: Investments & Putting Your Money To Work

Here’s the math behind it…

Historically the S&P 500 stock index has returned 7% per year.

If your portfolio is invested in the U.S. stock market – that’s roughly how much you can expect it to grow in any year.

Then you’ve got inflation. Over the last thirty years, prices in the United States have gone up – on average – by 2-3% per year.

So even though your portfolio grew by 7%… prices also went up as much as 3%…

Your real growth is 4%.

That’s where our safe withdrawal percentage comes from.

If you spend $45,000 per year on your current lifestyle… that means you’d need to have $1,125,000 to live entirely off your portfolio in retirement.

That might sound incredibly daunting…but it’s easier than you think.

Thanks to something Albert Einstein called “the most powerful force in the Universe.”

I’m talking about compound interest.

Let’s say you have $10,000 invested. It grows by 7% per year, and each year it builds upon itself. Within roughly ten years – you’ve doubled your money without any work.

If you keep saving every month, and padding your portfolio… it doubles even quicker.

We’ll be talking to investment experts who specialize in…[/text_block]

Five: International Living

Geographic Arbitrage.

You’re probably aware that the cost of living is different around the world. Even within the U.S. it’s significantly more expensive to live in New York than Memphis, TN.

If you look further abroad… the cost of living in places like South America, Asia and even Eastern Europe is far lower than anywhere in the United States.

Think about what that means for your retirement dollars.

Your dollar goes further… so you don’t need as much money to retire.

You can slash even more years off your “retire by” date.

Many of the interviews in the members area are with people who have left the U.S to live abroad or travel the world.[/text_block]

You Get Instant Access To A Library Of Interviews & Video Trainings Tailored To Improve Your Finances

It might be a new side hustle that can put passive income in your pocket. Or it might be a creative way to save money, while living better than you are today.

Here’s A Sneak Peak At Some Of The Interviews You’ll Get Instant Access To In The Four Percent Club Library [/text_block]

- Audio Interviews With Every Expert – Revealing their best tips, tricks and lifehacks for earnings… saving… and living better than you imagined possible.

- Video Training – Some concepts need more than just audio to explain, for those we’ll be doing special “how to” training videos.

- Transcripts of Everything – If you’d prefer to read the interviews – or you just want to search for a specific tip or section… now you can.

- Idea Summaries – I’ll give you a “bird’s eye view” of every technique, so you can discover all of the best content in under 15 minutes.

- Mind Maps – Are you a visual learner? I’ll be putting together mind maps for many of the interviews so you can visualize how everything comes together.

- Infographics – Sometimes a few graphs or a chart can say more than an entire book – opening your eyes to unforeseen risks, or amazing opportunities.

- Tools & Software – Get access to my private collection of tools that I use to earn more, save faster and live better.

[/text_block]

BONUS: The “Choose Your Retirement Date” Toolkit

One of the first you should use is my Early Retirement Calculator.

With it you’ll figure out exactly when you’ll be able to retire… and you’ll identify pain free ways to get there quicker. This knowledge is the foundation of financial freedom.[/text_block]

When you get into the members area, you’ll find plenty of material to assess your situation and start making a plan for early retirement. If you don’t have one already…

Listening to and implementing any one of the audio interviews or video trainings in the members area will help you to make a plan to shrink your “Retire by” date by decades.

Twelve months from now, you can look at your growing retirement fund with pride. And you’ll know that real financial independence is getting closer by the day.

You’ll have the option to retire. Or to take a sabbatical. Or even to keep working. Which is the real point – unlocking your options – so you can decide what your future looks like.

And you can get all of that for only $11…[/text_block]

And every month you’ll get another batch of fresh interviews and video trainings…

Plus unlimited access to ALL of the interviews, trainings and more that came before.

You Can Cancel At Any Time

If you ever want to cancel your membership – not that I think you will – you can do that at any time just by emailing me. I’ll process your request within 24 hours… and you will not be charged another dime from the time your email was sent.

So there is no risk when you sign up to try the 4% club today.[/text_block]

-

What do you get when you sign up for the 4% club?

What do you get when you sign up for the 4% club?You get instant access to a library of interviews and video trainings that you can immediately start listening to and watching. The information contained in these interviews and video trainings are designed to help you reach financial independence and retirement faster.

-

Who creates the information in the 4% club? How do I know it's good?

Who creates the information in the 4% club? How do I know it's good? I go out of my way to identify individuals who have become experts on these topics based on their own experience. For example the interviews and trainings on getting out of debt are done with individuals who had tens of thousands and in some cases hundreds of thousands of dollars of debt, when we talk about improving credit we interview people who have taken their score from mid 500's to high 700's and when we interview people on investing, it's people who are currently retired as a result of the good decisions they made managing their money. All our material is based on true, real life stories of people mastering their finances.

-

I have a question you didn't cover here. Can I contact you?

I have a question you didn't cover here. Can I contact you?Of course! I'd be more than happy to help answer your question. Simple email me and my team at brittany@brittanylynch.com