Are you happy with your current financial situation?

If not, today I want to share two apps with you: Digit.co and Acorns.com that will help you improve your finances without you even realizing it.

Both of these apps force you to save money…

Why I Love Them

Reason 1: They force you to pay yourself first and save money. Paying yourself first is an extremely important action for serious wealth building. The problem is many people are very bad at setting money away and actually saving. These apps help you do this automatically.

Reason 2: If you’re the entrepreneurial type and you don’t live on a fixed income then traditional saving advice isn't always applicable to your life because you don't know how much money you're going to earn each month. Digit and Acorns analyze your account activity and work with the money you have to help you save.

Here’s the rundown on both:

Digit.Co

This one is a 100% free, automated savings helper that’s targeted at Millennials and anyone who is just starting to save.

How Digit Works

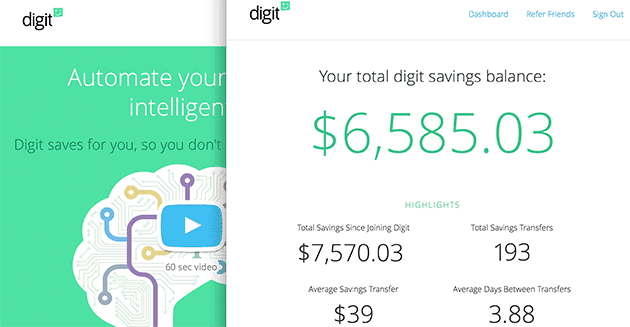

The general idea of Digit is that it helps you save tiny amounts of money every week by connecting your checking account to Digit.

Digit then analyzes your income and spending habits using it’s unique algorithm they’ve developed. The program finds small amounts of money it can safely put aside for you every 2-3 days usually between ($5-$50).

Digit will never transfer more money that you can't afford, so you don't ever have to worry about over-drafting your account. In fact, they even have a no over draft guarantee.

How do they determine how much to transfer?

Digit looks at four main factors: checking account balance, future income, upcoming bills, and your most recent spending habits. After they analyze the data, Digit figures out a “non-essential amount” based on your spending habits, so the money that transfers out of your account is money you won’t miss.

If you ever want to withdrawal your savings, you just have to send Digit a text message and they will transfer the money back to your checking account by the following business day.

So you don't have to worry that your money is tied up if you ever need to use it in an emergency or want to invest it.

They also allow unlimited transfers with no fees. Since they mainly rely on texts, you do have to pay for the texts to and from Digit, depending on your phone plan.

Is it safe?

Digit uses 128-bit bank-level security, and they don't store your bank login anywhere. So yes, it’s safe. But just make sure to regularly update your passwords and have a PIN code for your phone if possible for extra protection.

All funds held within Digit are FDIC insured up to a balance of $250,000.

So it’s about saving small amounts of money every month. Little chunks, add up to big change.

Acorns.Com

Acorns is an online financial advisor that helps you invest safely, without having to pay huge fees. It’s an automated process created by a team of engineers, mathematicians, and a Nobel Prize-winning economist (which always helps), and it creates and monitors your investment portfolio for you.

How Acorns Works

Like Digit, it’s pretty simple. You definitely don’t need to be the Wolf of Wall Street to start investing…

Just download the app on your phone and connect your bank accounts. Like Digit, Acorns is aimed at newbie investors or people who might not have a fixed income, but who want to start investing safely.

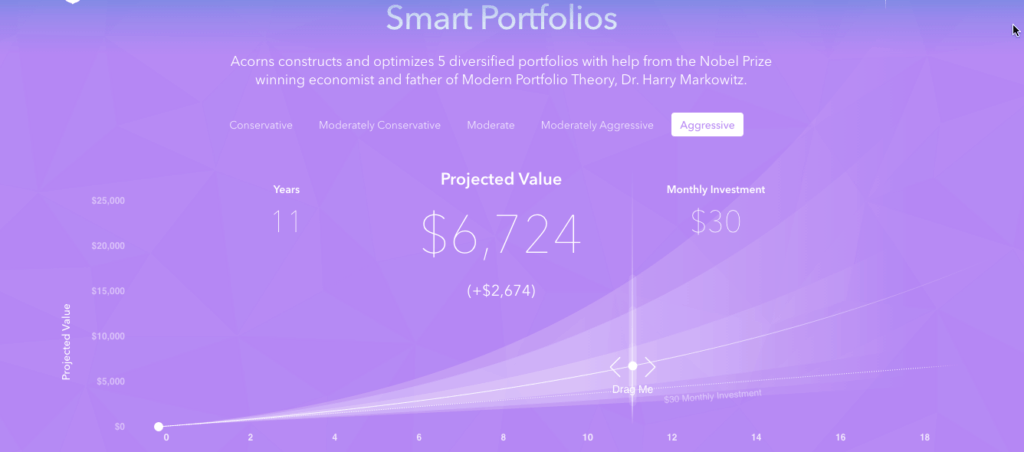

Next you need to pick an investment portfolio that works for your situation. You’ll get asked questions about your money and spending habits, and the app then assigns money to one of five portfolios.

There are also six options for basic index funds: Large company stocks, small company stocks, government bonds, emerging markets, corporate bonds, and real estate stocks.

So what does this cost?

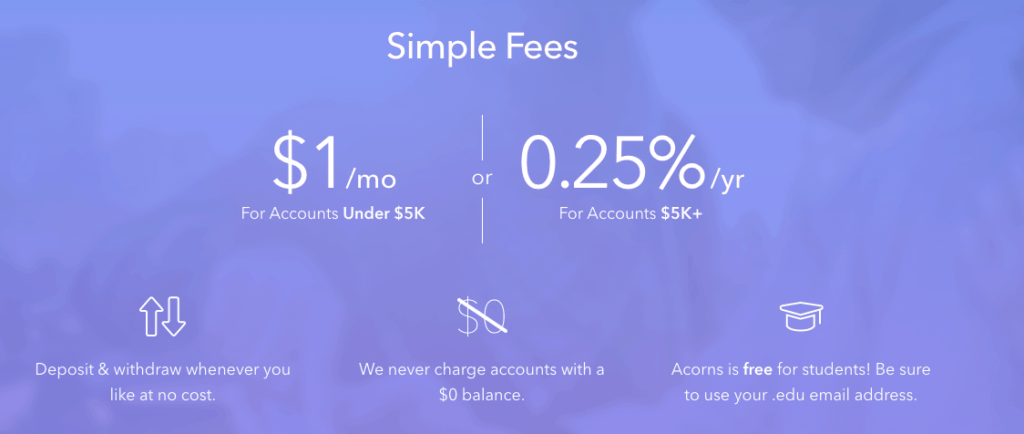

If your portfolio goes over $5,000, they charge 0.25% of your holdings every year. If you have less than that, it charges $1 per month.

How Do You Add Funds?

There are a few ways to add funds to your account:

1. Lump Sums: You can add or withdraw money just by inputting the amount on the Deposit/Withdraw screen whenever you want.

2. Automatic Investments (Recurring Deposits): Set up recurring deposits (daily, weekly, or monthly). Pick how much money you want to invest each time, and then pick the time period.

3. Round-ups: You can easily link your spending accounts to the app and then round up the virtual change from each of your transactions. Your round-ups are then moved into your Acorns account. When you enable this feature, automatic round-ups will be automatically invested for you.

How safe is it?

It’s safe. Acorns encrypts and protects all of your data with bank-level security.

The nice thing about Acorns is that it makes investing accessible and a little less intimidating. Plus it’s comforting to remember that their portfolios are developed with help from a Nobel Laureate also known as the “Father of Modern Portfolio Theory.”

Another perk?

Acorns doesn’t charge commissions for trades or rebalancing, so you don't have to worry about racking up fees.

Also, students invest for free! Since it’s targeted at the next-gen investor, all students and anyone under 24 can start investing with no management fees on accounts of any size. So if you’re in college and working two jobs, you can actually start investing your money early.

The Bottom Line

Acorns and Digit are next-gen, automated apps that help you get your finances in order, not matter what your checking account says. So if you’re afraid to invest because you think it’s too complex, or if you don't think you have enough money to save – think again.

Are you happy with your current financial situation? If not here are two amazing apps that will automatically build your wealth and help you improve your finances without you even realizing it.