We’re big fans of budgets. They’re the cornerstone of reaching your big financial goals. But budgeting can feel taxing and it isn’t the sexiest money topic out there.

Still, knowing how much you spend on what can help you find areas in which you can save money to put towards big goals like paying off debt or buying a home.

You have to track those expenses if managing your money is a priority. And it should be.

Pen and paper manual budgeting is pretty outdated and can be a real pain.

Luckily, we live in the age of tech and there are some amazing budget apps out there that can do everything from automatically track expenditures to helping you financially plan for the future.

With so many out there, how do you know which one to choose?

We did the research so you don’t have to. Here are the 6 best budget apps to help you save more, faster.

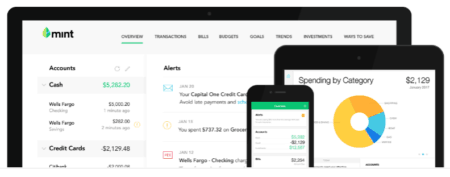

Mint

Mint is one of the most popular, if not the most popular, budget app. It’s a completely comprehensive app that not only helps you build a budget but also helps you manage several different aspects of your personal finance.

It’s really a total personal finance planning app as it helps you budget, save and invest.

It links directly to your bank account so you can pay bills automatically, track your spending, check your credit, and even track your investments.

It’s amazing because you can keep track of everything in one place. You can see your checking and savings accounts, credit cards, cash and everything else so you drop the ball.

Plus, it shows your budget visually so you know exactly how much is left in each category. It’s perfect for mobile and desktop so you can track on the go.

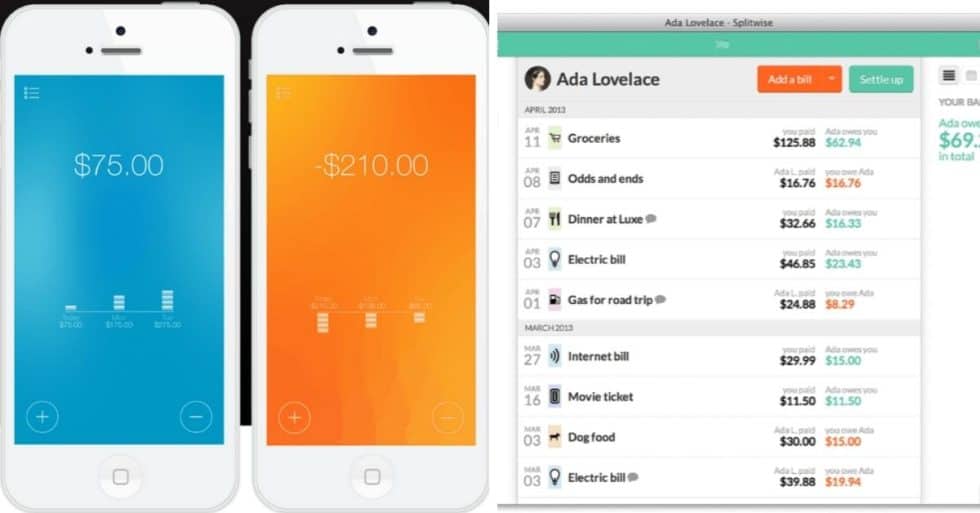

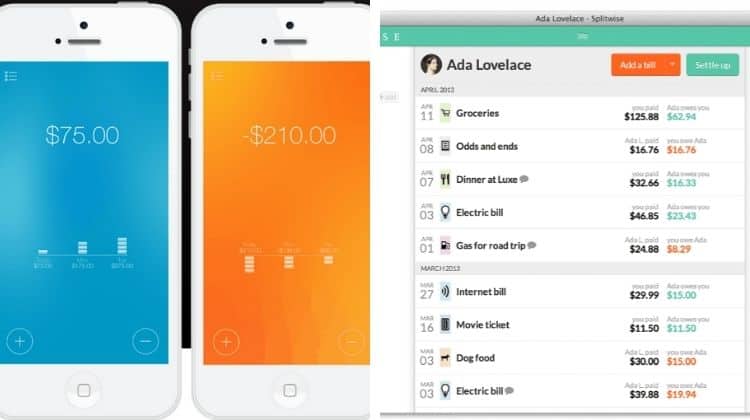

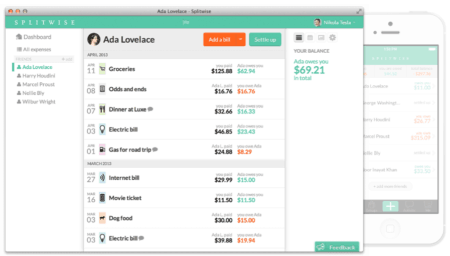

Splitwise

Splitwise is less of a budget app and more of an expense app. It’s a really helpful tool to use if you share expenses with someone like a roommate, friend, or significant other.

It itemizes any bills you need to split with another person and then does the calculation for you.

Whether you owe a person the full total, half, or they owe you, Splitwise makes it really easy to know how much you owe or are owed.

It integrates with Venmo, Paypal and credit cards so you can take care of your balance with just the click of a button. Plus, it sends you an end of month spending report so you know what your activity was like.

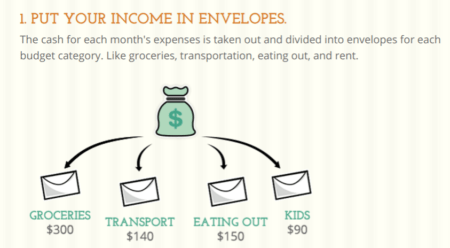

Goodbudget

This is a budget app that has a free and paid version so you can choose the option that best meets your needs.

I don’t think someone seeking a budget app for personal financial use really needs to upgrade to the paid version when there are other free comprehensive apps out there. But the paid option is nice if you have contractor, business, or just more in depth expenses.

Goodbudget puts a modern spin on an old-school budget method: envelope budgeting.

You get virtual envelopes and you break down your paycheck into different envelopes or categories like “groceries,” “savings,” “rent,” etc.

Then, when your envelope is empty for a category, you stop spending. Your household can access your envelopes so everyone can be constantly in the know about how much is left in any one envelope.

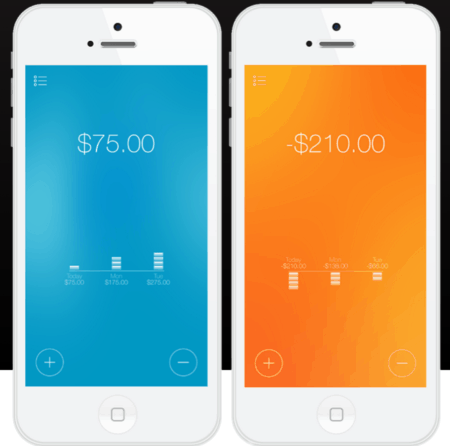

Daily Budget

This app is the simplest one on the list, so if you’re looking for a user-friendly, basic—this is it.

It’s really easy to use. You’ll enter your monthly gross income and fixed expenses and the app will automatically break that value down into how much you can spend per day. When you spend money, enter your expense to recalculate your remaining spending limit.

This is less of a planning tool and more of an expense tracking tool, but it just depends on your needs.

The only caveat is that it’s only available for iPhone as of right now, but is developing Android and Dropbox versions.

BillGuard

BillGuard is an awesome app because it automatically tracks spending. Instead of entering expenses manually, you just sync your bank account to the app and then each expenditure is tracked from a withdrawal in your account.

They’ll also alert you of suspicious charges and you can choose to approve expenses manually as an added layer of security.

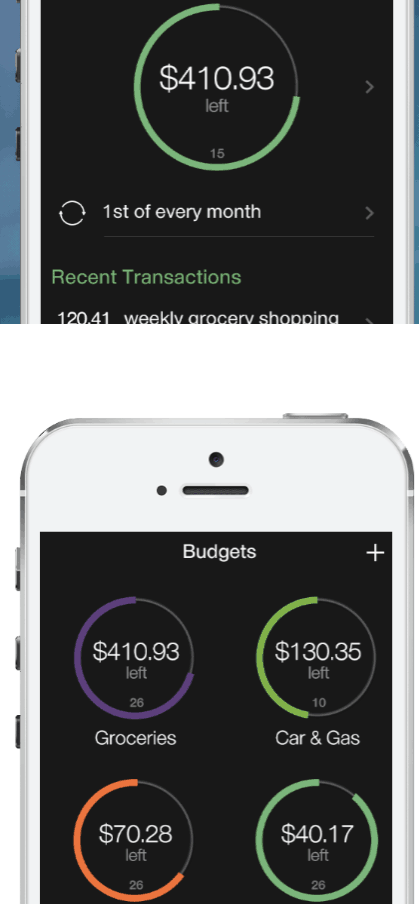

WellSpent

This is actually the budget app I’ve been using lately and I love it. It’s a great mixture of simplicity and advanced features.

For example, it allows me to easily categorize my spending. Each expense gets a different color so it’s easy to see immediately where your money is going.

It also allows you to set renewable budgets. So, let’s say I grocery shop twice a month. I can set one category at $100 on the 1st and then it will renew to $100 back on the 15th for my second cycle of shopping for that month.

This makes it easy so I don’t have to remember to update my limit in the middle of the month.

You can sync with as many devices as needed and can share your budget with family members or significant others.

Now, there are no excuses to stop you from managing your money. See what you’re spending so you can save more, faster.

So, which of these budget apps will you choose?

Want more tips on how to manage your money? Check out How To Build a Budget You Don’t Hate & Other Unsexy Money Things.