Having debt hanging over your head isn’t a good feeling. It can cause extra stress never knowing if you’ll be able to get on top of your finances and have the freedom to pursue your long-term financial goals.

Unfortunately, being in debt is common. Fortunately, that means there are lots of people who have been in your shoes and who came out on top.

Here are 15 debt bloggers who will teach you how to get out of debt so that you can breathe easier, and finally take control over your money.

Michelle Schroeder Gardner

Michelle’s blog is one of the absolute best personal finance blogs on the internet, covering everything from budgeting to self-employment. But it all started with her journey to pay off $40,000 in debt.

She used her blog to keep track of her progress and share her experience. Plus, she used to be a financial analyst, so she’s a pro at handling money.

She’s one of my favorite debt bloggers and still shares other incredible debt payoff stories, and has a wealth of information available to help you learn how to pay off your debt for good.

Melanie Lockert

Melanie has her own amazing debt story. She paid off $81,000 in student loan debt and started the journey to become self-employed.

Her blog has a series called “Dear Debt Letters” where readers can write letters detailing the ups and downs of their own debt journeys.

It’s guaranteed to keep you motivated and let you know you’re not alone.

Via Dear Debt

Johnny & Joanna Galbraith

Johnny and Joanna are debt bloggers who use their personal finance blog to help you learn to live with a budget that doesn’t restrict you but rather works with you to help you achieve your long-term financial goals.

They’re witty, funny and charming. And their blog will teach you the best budgeting tips you could ask for. Their aim is to help you build a budget you don’t hate. Plus, they still use many of the core budget strategies that helped them pay off their student loan debt.

Cait Flanders

Cait’s blog focuses on her recovery from her self-proclaimed “bad spending habits” that landed her in $28,000 worth of debt.

Since beginning her blog, she has not only paid off all of her debt, but she has also reformed her spending habits to become a mindful minimalist.

She chronicles her journey through different spending challenges, and there are tons of archived posts covering all the real ups and downs of figuring out your finances.

Via Cait Flanders

Jordann Brown

Jordann is one of our favorite debt bloggers. Since paying off her debt, Jordann has become a master saver and shares updates on her financial goals like saving for a down payment and renovating her backyard.

She shares all of her saving strategies and even provides regular net worth updates so you can follow her entire finance journey for the ultimate inspiration.

Peter Adeney

Mr. Money Mustache is all using frugality to live the life of your dreams. He saw how many of his friends were struggling with debt or living paycheck to paycheck and decided to share his money savvy wisdom with the world.

You’ll learn the best tips for living well and frugally.

Liz & Nate Frugalwoods

Speaking of frugal, Liz and Nate might just be the King and Queen of frugal living.

They decided to give up their fast-paced lives in Cambridge for a homestead in Vermont where they embrace simple living to its fullest.

This isn’t so much a debt blog as a simple living blog, but you’ll learn so many tips for living frugally, saving more, repurposing, and just generally consuming less.

Via Frugalwoods

Deacon Hayes

Well Kept Wallet is a great blog that covers a variety of money topics from saving, living rent-free, and revamping your career.

He also has an incredible series where he features amazing debt stories from people who have paid off huge amounts of debt.

It’s nice to look forward to those stories from others who have been in your shoes or are currently working through paying off their own debts.

It’s great for getting some insight on the different circumstances that put you in debt and the different strategies used to get out of it.

Via Well Kept Wallet

Lance Cothern

Lance and his wife paid off $80,000 in student loan debt in just 3 years and are now spreading their knowledge and sharing their journey from debt-riddled millennials to personal finance pros.

His blog is all about spending smarter, finding ways to boost income, and paying off debt steadily and strategically.

I find his blog to be very thoughtful and steeped with personal experience. It’s great to learn from someone who accomplished an amazing feat so quickly. He has a great newsletter so you can receive motivating tips and tricks on the regular.

Via Money Manifesto

Zack & Jen McCullock

Zack and Jen are millennial money managers who aim to teach you how to take control over your finances by introducing their favorite tools and tips for properly handling your finance world.

They have a lot of great recommendations for apps, programs, and resources that can help you do everything from save, budget, and invest in a digital world.

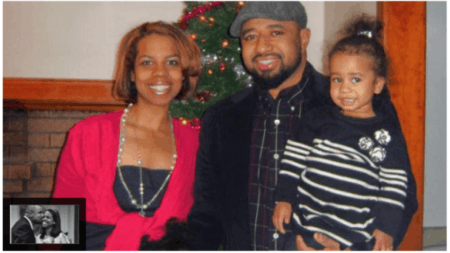

Aja McClanahan

Aja has one of the most amazing debt stories I’ve ever heard. She paid off $120,000 in debt while simultaneously growing a six-figure business!

She writes that she and her husband “moved to the hood” to save more to put towards their debt repayment, and now she wants to help others do the same.

Her blog is a great mix of posts about her debt repayment, blogging and business, and some lifestyle posts mixed in. She also publishes her income reports so you can see firsthand what’s working for her.

Bobby Hoyt

I think Bobby’s story is really relatable. What’s most inspiring about his story is that he paid off $40,000 of debt on a teacher’s salary…in just a year and a half.

That’s a pretty amazing feat, and he isn’t stingy on sharing the details of his debt repayment journey.

He also offers plenty of advice on investing, entrepreneurship, and managing money in the millennial age.

Carrie Nicholson

Carrie paid of $14,000 worth of debt, which is definitely on the lower end for this list, but her posts about the struggles and stress of feeling indebted while trying to launch a business is all too relatable.

It goes to show that any amount of debt can take its toll, mentally and physically. She now devotes her time to helping others create the lifestyle businesses of their dreams.

Her blog is all about learning to earn money on your own terms rather than viewing money as something that controls you.

Via Careful Cents

Chris Peach

Chris moved from paycheck to paycheck living the life of location independent self-employment.

He has a killer podcast in which he discusses a variety of money topics, as well as a money course that will teach you positive spending habits. But, between you and me, he offers plenty of free content that does just that.

Via Money Peach

Ms. Montana

Ms. Montana (aka Jillian) and her husband went into their marriage with a combined $50,000 worth of debt.

They felt tied to their 9-5 jobs, which is something a lot of us can relate to.

They paid off their debt over time which freed them up to pursue financial freedom in the form of flexible careers filled with travel and adventure.

Her blog focuses on living the life of your dreams while keeping expenses low. They paid cash for their home and now aim to spend smartly.

She even has 5 little ones at home, so you can bet on plenty of advice for balancing a family budget.

Never fear, paying off debt can feel like an insurmountable goal, but here are 15 amazing people who are living proof that you can do it.

These debt bloggers have tons of first-hand experience and wisdom to share to help you make debt repayment possible.

Want more? Don’t miss 8 manageable ways to get out of debt.