So, you’re looking to manage your money? Well, you’ve come to the right place then. Looking to buy a house? Want to start saving for retirement or defeat the debt snowball once and for all? Maybe you just want to have control over your money. The thing is, it doesn’t matter what your goal is because managing your money starts right here: with a budget.

Queue the cringing. We know, budgeting has a tendency to elicit less than overjoyed reactions, but they aren’t as scary or restrictive as they might initially seem. In fact, they are the absolute essential first step to managing your personal finances. It’s the building block that your other, bigger financial goals depend upon.

After all, you can’t save if you don’t know what’s going out and what’s going in? Right?

Meet Joanna and Johnny.

They’re the duo behind ourfreakingbudget.com, a personal finance blog dedicated to, you guessed it, budgets. Since becoming the budget gurus they are today, they’ve paid off $20,000 of debt, saved up an emergency fund, and even invested in starting a small business. Joanna and Johnny are the first to admit that budgets are the least sexy part of personal finance, but they also swear by them. Why? Because budgets are the cornerstone to achieving all of your financial goals, which are the sexy part of personal finance.

Step 1

Find Your Motivation:

Budgeting is hard. Really hard. It can feel restrictive, so being able to identify why you have a budget is the key to staying motivated.

“It's a lot like starting an exercise plan or a diet. When times get tough and it's raining outside and you don't want to workout and there's an opportunity to eat some food that you shouldn't. What are you going to lean back on when times get tough? That's really the motivation. You got to have a motivation so that, again, when you fail and you can get back on the horse.”

Find the goal that underlies starting a budget: getting out of debt, saving for a house, saving for retirement, having control over your money, etc.

You also want to prioritize your motivations. For example, if you have high-interest debt, that should be your first priority before you save for a house. Build up your emergency fund as well, so that you’re covered when life throws you an unexpected curveball. Fund your financial foundation before you tackle bigger investments.

Step 2

Find Out What’s Going Out & What’s Coming In:

In order to create a budget for the month, you have to have accurate knowledge of how much money you’re earning each month and how much of that earned money you’re spending. Track your spending and your earnings. Check your bank statements, or use a money management app like Mint to find out how much you’re earning, and conversely, how much you’re spending.

Your bank statement itemizes this information so you can see a total of all of your withdrawals vs your deposits for the month. If you have credit cards, you’ll also want to factor in credit card spending. Use spending data from previous months in order to start planning for your budget.

Aside from calculating how much you’re spending, you also want to track where you’re spending that money. How much is your rent? How much are you spending on eating out and entertainment? Tracking what you spend money on is the first step to figuring out where to make adjustments or where to cut spending if you need to. Make a spreadsheet and track each category you spend in so you have an overview of all of your monthly spending.

Step 3

Categorize Your Spending:

Now that you know how much is going out and how much is going in, you can start actually creating your budget. This means breaking up what you need to spend money on in a month into categories with specifically allocated spending amounts. Categories can be as broad or as specific as you want. Some common categories include rent, groceries, internet, personal care, and entertainment.

So, you’re ready to categorize your budget. Where do you start? We created a worksheet that will help you categorize your budget based on your specific income and needs.

Break your expenses down into fixed expenses vs variable expenses.

Fixed Expense: A fixed expense is something that you know you’ll be charged the same amount each month like rent, utilities, insurance, internet etc

Variable Expense: A variable expense is something that changes monthly based on your choices like grocery spending, clothes, entertainment, personal spending, etc

You can further segment these down into non-discretionary expenses vs discretionary expenses.

Non-Discretionary: Non-discretionary expenses are items that you cannot make it through the month without. These are necessities to your lifestyle such as: rent, gas, internet, insurance, utilities, etc. This is subjective, so figure out what is essential for your lifestyle.

Discretionary: Discretionary items are things that you may enjoy and like, but aren’t essential to the basic, happy functioning of your life. They include things such as entertainment, eating out, personal spending, beauty, etc.

Okay, so now you’ve broken down all of your expenses into categories, but now how do you figure out how much to allocate to each category?

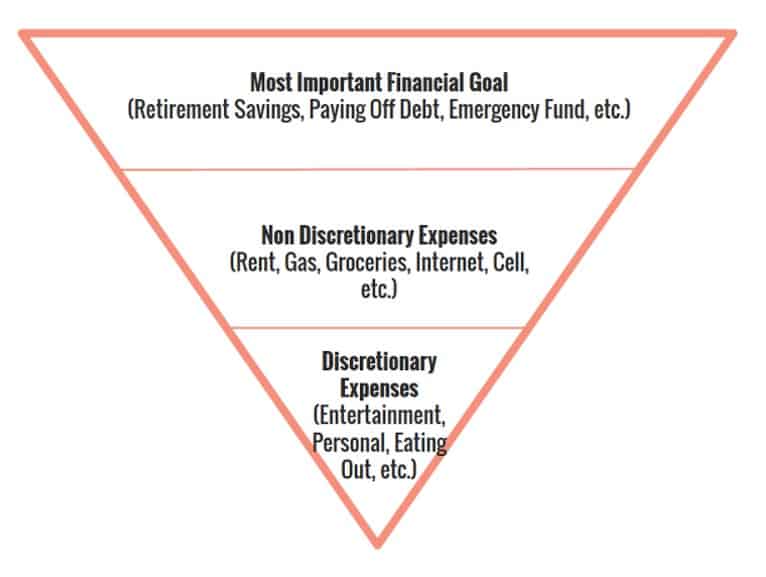

Use Backwards Budgeting.

What is it? Backwards Budgeting is a way of allocating budget funds to categories based on importance. You start with your most important financial goal and work backward until you get to the least important or prioritizes expense categories.

Backwards Budgeting does work backward but think of it like an inverted pyramid.

The logic goes a little like this:

1. Take your income for a given month, then decide what your absolute most important financial goal is, whether that’s paying off debt, saving for retirement, saving for an emergency fund, or any other financial goal.

Take the following example:

Monthly Income: $3,000

Most Important Financial Goal: Emergency Fund

Monthly Contribution: $400

That leaves you with $2,600 for everything else.

2. Take that leftover amount (in this case $2,600) and divide it among what you need for your non-discretionary expenses. This is the stuff you can’t afford to do without, so it gets prioritized next.

Rent/Mortgage: $1,100

Utilities: $250

Groceries: $300

Insurance: $250

Cell Phone: $100

Total: $2,000

3. Finally, take whatever amount is left and divide it among your discretionary expenses.

Download our Backwards Budgeting worksheet for more specific examples of how much to allocate to each discretionary category, and detailed recommendations on which categories to create.

Working backward from your most important financial priority to the non-essentials can help you keep a clear perspective. If you get to your discretionary spending and realize you don’t have enough to allocate to some discretionary categories such as buying new clothes or eating out, it can help remind you that your money is going towards other more important allocations.

Alternatively, if you realize you don’t have enough leftover to cover all the discretionary spending you’d like, you can explore ways to make cuts or save money. Rewards programs can help you cut down costs or even get something for free. For example, this man flies first class for free all because he knows how to use airline reward points to his advantage. If you really just want to boost your cash flow you can always pick up a side hustle.

Step 4

Have an “Everything Else” Category:

This is a pro-tip we picked up from Joanna and Johnny. If the idea of ceremoniously assigning every single dollar to individual categories tempts you to run away screaming, you might want to give this tip a try.

An “Everything Else” category groups any expense category that might vary from month to month such as gifts, pet supplies, medical expenses, or personal spending into one master category. Then, you simply assign an amount to the overall category. For Joanna and Johnny this is about $300 per month. To find your “Everything Else” category overall budget amount, you still estimate how much you’ll spend in each of the comprising categories to get the overall total. It just provides more flexibility within them.

With an “Everything Else” category, it doesn’t matter if you spend $5 on pet supplies one month and then $50 on pet supplies in another month so long as your spending in each of the individual categories that makes up your “Everything Else” category doesn’t exceed that $300 amount.

An “Everything Else” category can help you feel like you have a little more freedom and breathability within the budget so you don’t get frustrated or stifled. It also simplifies things so you don’t have too many categories and get overwhelmed by varying monthly expenses.

Step 5

Check In Daily & Monthly

Tracking your expenses is the only way to know for certain if you’re hitting your budget goals.

Monthly budget check-ins can help you evaluate your success for the month and gives you an opportunity to adjust allocated amounts within categories. Perhaps you thought you’d only need $200 for groceries, but quickly found out you needed to increase that for the following month. This is the perfect time to evaluate your monthly spending and make the best choices for the month ahead.

You also want to check in daily. Consistency really is the key to budgeting. It’s too easy for things to slip your mind and for some of the many things you may purchase in a day to slip through the cracks, so add in all your daily expenses at the end of the day. Use a manual budgeting app like HomeBudget to track daily spending and ensure that you’re up to date on whether or not you’re on track to hit your goals. Find out why Joanna & Johnny prefer HomeBudget over Mint in the full interview. Manual budgeting vs automated budgeting apps, where you can choose to only check in once a month like Mint, forces daily check ins which help keep you on track.

Manually typing that you spent $8.50 on a green juice also hurts a lot more than having Mint track it automatically. Sometimes a little tough love can keep us on track.

Step 6

Be Realistic & Be Flexible

Having realistic goals and expectations for yourself is what’s going to make budgeting sustainable. Just because someone else chooses to contribute $700 a month to their emergency fund doesn’t mean that you can’t save $300 a month and still reach your goals. Be realistic about what works for your lifestyle. If having an aggressive savings plan excites you, then go for it! If you want to take a more moderate approach, that’s a-okay too. Personal finance is just that: it’s personal.

If you have trouble sticking to your budget, try using a cash-based budget, at least in the beginning. A cash-based budget means you don’t use credit or debit cards to make purchases. You only use cash, and you withdraw your monthly budget’s worth at the beginning of the month. If you run out of cash for that month, you’re done spending. Watching cold hard cash dwindle down with each expense or purchase can help those of us who might be guilty of spending more behind the veil of a plastic card make more conscious spending choices.

Part of being realistic is also being flexible. That first month, you’re not really going to have concrete numbers for everything you’ll spend on. It’s trial and error, and you’ll have to make educated guesses and then adjust for the following month. Be aware of this so that you will be ready to make adjustments for a future accurate budget. You may even be making adjustments months down the line because as life changes, so do your needs and goals. Your budget is an evolving thing. Life changes and so will your budget.

So there you have it: The 6 steps to building a budget you don’t hate so you can start saving for what really matters. It all really does start with your motivation. Keep that in mind when that restaurant dinner is calling your name. Always be mindful of your budget motivation, track your expenses daily to stay on track with your spending goals, and be realistic and flexible so that your budget can become a part of your lifestyle and not a thing to loathe.