Do you ever daydream of swapping your day job for days at the beach or to spend time with you kids, or just to pursue your favorite hobby while still having a steady stream of annual income to support yourself? Don’t we all?

Well, it really doesn’t have to be just a dream.

Enter Paula Pant, the real-estate savvy blogger behind affordanything.com. Paula reached financial independence by the time she was just 30 years old by generating passive income from real estate investments.

That’s right, Paula is able to support her entire lifestyle with passive income.

How is this possible?

Paula achieved something called financial independence. Financial independence essentially means that you can cover all of your living expenses through passive income. There are many different ways to create passive income, but Paula does this by investing in real estate properties using a buy-and-hold strategy.

(Note: Want to know more about financial independence?

Learn how one guy retired in under 10 years.)

What does that mean?

That means she invests in properties and then rents them out to tenants who provide her with a recurring stream of passive income, which Paula is then able to use to support her lifestyle while still contributing to her retirement funds.

Sounds like a pretty sweet deal, right?

Before we get started, there are 4 basic benchmarks to establish before getting your hands dirty in real estate investing.

Before Investing

The most important things to focus on when evaluating whether or not to invest, and even after investing, are saving fundamentals. Paula is a huge advocate for sticking to those fundamentals and she recommends practicing saving fundamentals in spite of seeing huge success from real estate investment passive income.

- Pay Off Credit Card Debt or Any Other High Interest Debt

- Build Up an Emergency Fund to Have a Financial Security Blanket

- Contribute to Retirement Funds Like Your 401k, IRA, etc

- Do Your Homework and Learn as Much as You Can About the Industry Before Investing

Check out books, the web, or any other resources that can help familiarize yourself with real estate investment. Paula recommends From 0 to 130 Properties in 3.5 Years by Steven McKnight.

Now, once you know that you’re ready to invest in real estate and that you’re in a position to do so, there are 3 steps to successfully generate passive income from buy and hold rental property investments like Paula.

The three steps Paula outlined are:

- Find Your Real Estate Niche

- Choose the Right Properties to Invest In

- Build a Great Team

Step 1: Find Your Real Estate Niche

There are two types of niches in real estate investment. There are niches in the properties you invest in and there are niches in the money making strategy you pursue once you’ve acquired your property. Your money making niche (or investment strategy) may even be influenced by the type of properties you choose to specialize. For example, Paula specializes in buying and holding residential properties.

Property niches are different types of properties that you can invest in. Most people automatically think of single-family homes, duplexes, triplexes, or even fourplexes, but those aren’t your only options. Retail spaces, commercial buildings, and mobile home parks are also viable options. Money making strategies involve what you do with that property. Do you flip houses? Do you buy-and-hold? Do you want to invest in tax liens?

Ahhh, so many niches! How will you ever find yours?

Identify your goal.

Do you want real estate to replace your full time job or are you looking for real estate to produce truly passive income so you can spend that time doing other things?

Once you identify your goal, you can basically work backwards because whatever you choose as your goal from investing in real estate will influence the niches and strategies you choose.

For example, flipping houses as your money making strategy is generally a full time venture. Why? Because there is no recurring income. You buy a property, renovate it, and then re-sell, but it’s a one-time pay out. Then you have to start all over again with a new property.

On the other hand, buying-and-holding like Paula is more of a part time gig. You rent your properties out to tenants so they generate recurring income with less work. There’s more turnover, and once you get your property rent ready, you can keep renting it out over and over.

Step 2: Choosing the Right Properties

This step is so important because, again, this is 90% of the game. If you invest in a good, solid property, you can figure out the rest as you go along. This is true regardless of what money making strategy you pursue.

For the rest of this post though, we’re going to focus on Paula’s specialty: the buy-and-hold strategy.

When buying-and-holding, choosing the right property comes down to metrics. When people are buying a personal family home or space, they buy with their emotions and how the house makes them feel. When buying an investment property, we want to use math.

The 1% Rule

This is the first metric we want to use when choosing which properties to invest in. This rule is used as a “first-pass” which means you don’t buy every property that meets it; you just eliminate all the properties that don’t.

The 1% Rule states that the monthly rent of the property must be at least 1% of the total acquisition price.

What is the total acquisition price? It includes the price you pay for the property itself plus any additional money needed to make it rent-ready.

So, if you purchase a property for $150,000 and then put in an additional $50,000 dollars in renovations, your total acquisition price is $200,000.

So this $200,000 property needs to rent for at least $2,000 a month to meet the 1% rule.

“But that’s crazy!”

If you’re thinking it’s impossible to reasonably price rent at 1% of the total acquisition cost, trust us. It’s entirely doable. Get creative with the properties you look into or the locations you choose to look in. Paula recommends considering situations such as investing in a two-bedroom property that can be converted into a three-bedroom property and price it according to that three bedroom rent price. Look into rural communities outside of cities if there’s nothing in that city, or even consider investing in cities outside of where you live.

Paula lives in Las Vegas but has all five of her rental properties in Atlanta. So, finding properties that fit the 1% metric is entirely possible.

Find The Price-to-Rent Ratio

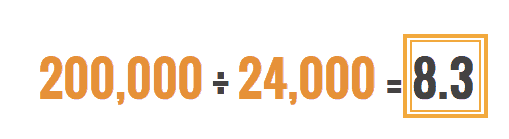

The Price-to-Rent ratio measures the annual income you will receive from a rental property in relation to the price of the property. Paula looks for properties with a Price-to-Rent ratio of 8.3 or lower.

To calculate your Price-to-Rent ratio:

Taking the same example from above, let’s say you have a $200,000 property and the monthly rent is $2,000. $2,000 over twelve months gives you $24,000 in annual rent.

Find Your Capitalization Rate to Determine ROI

The Capitalization Rate of a property is a direct measure of the return on your investment by taking the cost of operating and maintaining a property into account. This is important because if it predicts a low return, you may want to pass on that property.

The Cap Rate is basically annual net operating income divided by price. Calculating this rate involves calculating your effective gross rent, gross operating income, operating overhead, and your net operating income. It’s definitely the most involved calculation when determining which properties to invest in, but it’s worth learning.

Don’t get overwhelmed by all of this, we’re going to break it down into a series of examples to make these calculations a little easier to digest.

Effective Gross Income:

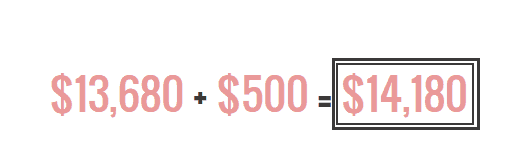

This is income after vacancies. Let’s say you have a property that rents for $1,200 a month. That gives you a total annual rent of $14,400 for the year. Now, let’s say you have a 5% vacancy rate:

After your vacancies, you actually make $13,680 per year which is your effective gross rent.

Gross Operating Income:

Take any other income you make from the property (non-refundable pet fees, on-site laundry machines, parking, etc.) and add it to your effective gross rent to figure out your gross operating income. So consider that you make $500 in additional fees. Take that number and add it to your effective gross rent.

Operating Overhead

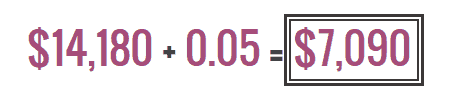

Once you have these numbers, we want to figure out how much it will cost you to operate and maintain the property excluding the cost of financing. This is your operating overhead. Your operating overhead includes capital expenditures like repairs or maintenance on foundation, siding, roofing, air conditioning, etc. It should come to about 50% of your rent over the long term, so calculate 50% of the gross operating income you just calculated.

Net Operating Income

To calculate this: Take your gross operating income and subtract your operating overhead.

Capitalization Rate

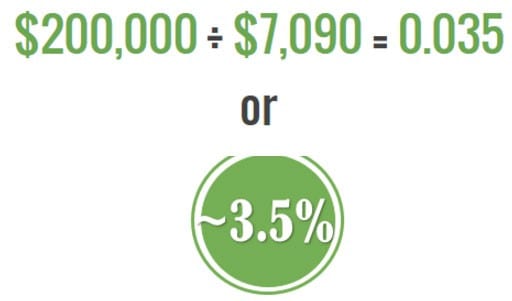

Finally, to find your capitalization rate, divide your net operating income ($7,090) by the total cost of the property ($200,000 to buy).

This property would yield an approximate 3.5% return, which Paula says she’d walk away from.

Paula looks for at least 6-7% capitalization on Class A properties.

What is a class A property you ask?

There are three property classes. Class A,B and C

Class A properties produce the lowest returns but also the least amount of risk. These properties have high-quality tenants; safe neighborhoods; low turnover and vacany.

Class B properties produce slightly greater returns but also slightly more risk. These have mid-quality tenants; moderate neighborhoods; some turnover and vacancy.

And Class C properties produce great returns but a lot more risk. These typically have low-quality tenants; are in crime ridden neighborhoods; have high turnover and vacancy.

To figure out what returns you want to see before purchasing a property it’s important to determine your risk tolerance.

Step 3: Build A Reliable Team

If you’re buying and holding properties, or even if you’re using a strategy like flipping houses, the work doesn’t end once you obtain the property. There may be things you need to take care of to get the property rent ready, and if you’re buying-and-holding, you’ll need to maintain those properties for new and existing tenants. You’ll need a reliable team to help do this.

Not only does having a network or team provide you with reliability for your properties, but it also saves you time down the road. This is why building working relationships is so important.

This includes contractors, electricians, gardeners, and others who can help run and maintain a property, especially if you do not live in the same area as the properties you own.

Paula’s manages her properties remotely and she’s able to do this because she has a team of people with whom she has strong working relationships. She knows exactly who she’ll call for windows, counters and everything else, so she doesn’t need to spend extra time vetting different vendors or contractors.

Talk to others in the same market to find common investment goals and work on actively building and maintaining those relationships. Building your team may take some time or be trial and error, but it’s worth building those relationships.

There it is:

The 3 Steps to Achieving Financial Independence through Real Estate Investment.

Start by making sure you’re financially and knowledgeably ready to invest. Then, find your real estate niche by identifying your goal (in our case, to achieve financial independence), and then use metrics to choose the best properties to invest in. Finally, develop working relationships to build the best team you can to help operate and maintain your investments.

Did you like this post? If so, share or comment below!