To me the ultimate reason to pursue financial independence can be summed up in one word.

Freedom.

When you reach financial independence you gain more freedom over your time, freedom over your location and freedom over your decisions.

You get to decide how you want to live your life and have the financial means to do so.

You have enough personal wealth to live, without having to work actively to cover your expenses. Put another way your assets generate enough passive income to cover your expenses.

Later in this post I'll go over the different ways to generate passive income.

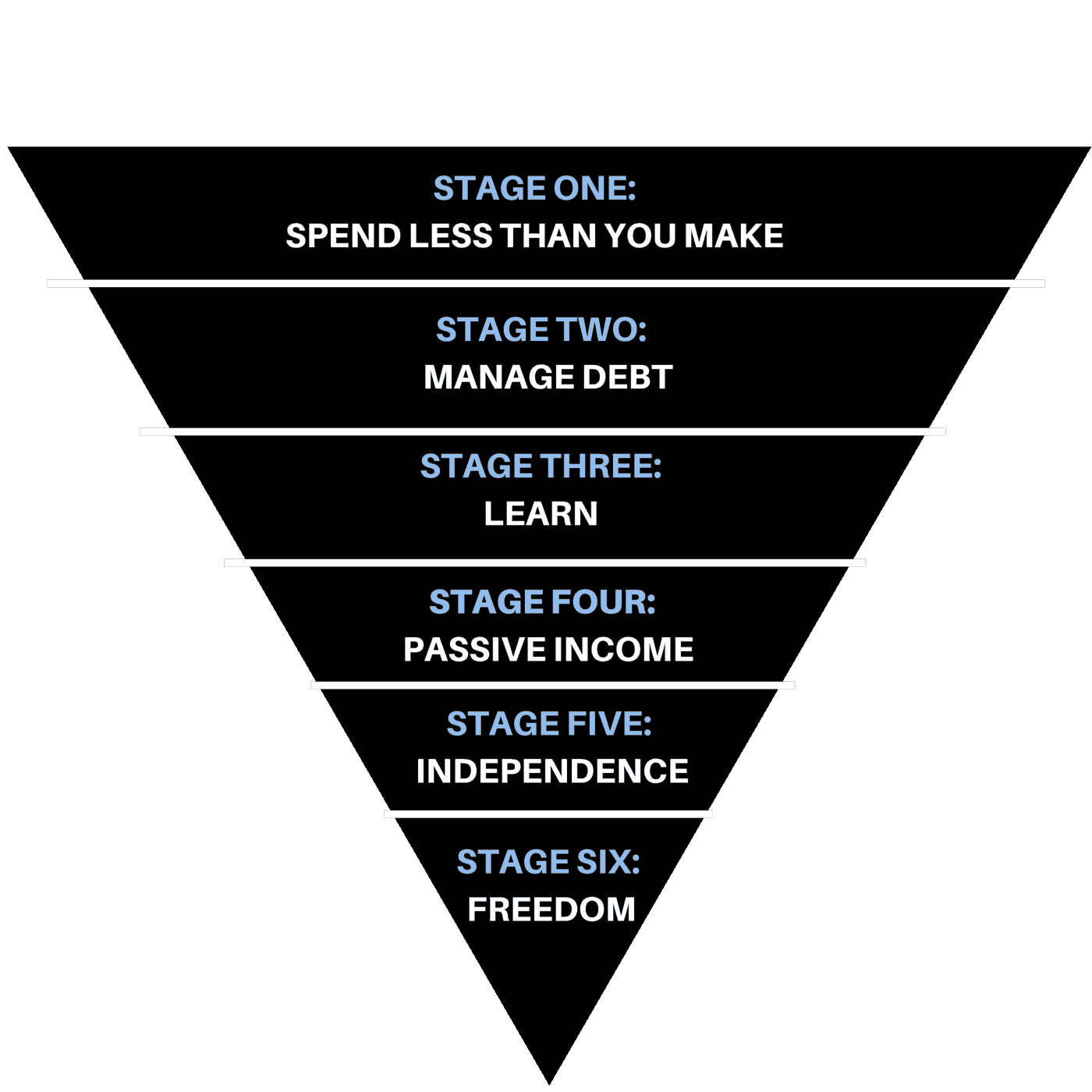

In this blog post I want to break down the six stages or steps to financial independence in order to help you identify where you are, and give you specific action steps to focus on in order to ascend to the next level.

Stage 1: Spend Less Than You Make

In this stage it’s extremely important to start to live below your means. Your income must surpass your monthly expenses.

You can do this by one of two ways:

Increase Your Income (See below)

Or

Reduce Your Expenses

In this stage the goal is to start to age your money and break the paycheck to paycheck cycle by living off of money you earned in previous months.

In order to progress to the next stage, you must get current and up to date on all of your bills and build an emergency fund of $1,000.

Stage 2: Manage Debt

By progressing from the last stage it means you’re current on all of your bills…but, you still have debt.

In this stage you need to make a plan to get rid of your debt as fast as you can.

There are two methods that are used most commonly when conquering debt.

The Debt Snowball Method & The Debt Avalanche Method

The Debt Snowball Method is a method of debt repayment which focuses on putting any extra money towards paying off debts, starting with the smallest amount owed first and then progressing to those with the highest amount owed, regardless of interest rate.

The methodology behind this approach is that many people have many small debts and that it can be overwhelming to have so many unresolved issues.

Using the debt snowball method, it can be motivating to scratch debts off your debt to do list, which can propel you to tackle the next one faster.

The Debt Avalanche method on the other hand, focuses on paying off high interest debt first regardless of how large or small that debt is.

The Debt Avalanche method typically makes more sense when it comes to crunching the numbers and looking at what saves you the most on interest.

A simple Google search on both of these methods will show that there have been thousands of success stories for each method. At the end of the day, the important thing is to choose one of these methods and stick with it.

Stage 3: Learn

In this stage you need to fully fund your emergency account or buffer account in case of unexpected expenses or opportunities that come your way.

Your emergency account should have enough in it, to cover about 4-6 months of your living expenses.

You should begin to identify your life & financial goals and spend some time learning about personal finance and investing.

This is extremely important for when you reach the “Asset Accumulation” stage in the next step in order to build your assets which will ultimately help build the passive income you need in order to retire.

Stage 4: Asset Accumulation & Passive Income

In this stage your focus is on creating income producing assets that spit out enough passive income that you can cover your living expenses.

The most common or widely talked about approach to doing this is by investing your savings into stocks, bonds, annuities and your 401k with the ultimate goal that down the line you’ll be able to live on dividends and appreciation of your investment.

In my opinion, even if you are creating passive income in other ways (see below), everyone should focus on saving and investing at least 10% of your income, ideally more.

Your savings rate has a direct impact on the speed at which you’re going to be able to retire using this method. For example if you save 10% you have 51 working years before you can afford to retire. If you save 25%, you can retire in just 32.

To learn more about early retirement, be sure to read this post: Step By Step Plan To Early Retirement..How Justin Did It In Under 10 Years

Here Are A Few Other Ways To Create Passive Income

- Sales Of A Digital Product/ E-book/ Recurring Monthly Membership Site

- Royalties From The Sales Of A Book/ T.V Show/ Movie/ Song

- Affiliate Marketing

- A Blog

- Investments – Stocks, Bonds, annuities, 401ks can give you a solid return over time when done right.

- Real Estate Investment – Rental Properties Long Or Short Term on Airbnb

- Create a Software As A Service (SAAS) – The Software version of a digital membership site.

- E-commerce Drop Shipping

Before we move on, I want to clarify one thing.

Passive income does not mean free money.

Any passive income stream starts with a period of active work.

You need active work initially in order to create that passive income stream. You do the active work with the view that ultimately you can transition the income into passive.

This holds true whether your plan is to set up a blog, create a digital product, working a job and investing your savings or launching an E-commerce site.

I use many of these passive income streams however I have a few primary focuses that work together to create one system. For me that's, using blogs to grow and connect with my audience, monetize that audience with affiliate marketing and digital products that I create or publish.

One thing to note is that I do this in many niches, and in most I'm not an expert on the topic, and you don't need to be either.

I leverage other peoples expertise on that topic to create high quality content & products and establish myself as an authority. This has many advantages, one of which is that I don't have to spend much, if any time writing.

If this is interesting to you, I'll talk more about this in the next few days on this blog so keep an eye on your inbox.

I’ll also releasing a new course that will go over my system for creating passive income, next week. I'll only be opening up 100 spots in the course and then I'll be closing it down for the next few months. To get notified first, enter your email below.

[thrive_leads id='9035′]

Okay – before I move on to the next stage, in this stage you should also look at ways you can optimize and reduce your taxes, ensure you have a will and insurance in case anything happens to you.

Stage 5: Financial Independence

You did it. Congratulations!

In this stage your current lifestyle expenses can be met with your passive income.

You can choose to quit working, change careers into something you’re more passionate about or kick back and relax.

Stage 6: Financial Freedom

In this stage you grow your wealth beyond covering just your monthly expenses.

Not everyone chooses to progress to this stage.

Maybe you’ve expanded your goals and want to tackle a new adventure or perhaps you want to do more charity work and be in a position where you can give back more or maybe you just want to leave a legacy for your children and your children’s children.

Whatever it is, your focus here is on continuing to grow your wealth beyond what you need on a month to month basis.

So there you have it.

The 6 stages of Financial Independence and Freedom.

Use this post to identify where you are, and clarify your goals to progress to the next step.

To your success,

Brittany