Do you have a bad case of wanderlust? Ever dream of ditching your day job and retiring early to go travel the globe? A lot of people think of traveling as a luxury they can’t really afford when saving up. If you’ve been bitten by the travel bug we have good news for you. Geographic arbitrage is your ticket for seeing the world while saving up a storm on your way to early retirement.

What is Geographic Arbitrage?

Geographic arbitrage is a financial concept in which you live somewhere in the world that has a lower cost of living and where the exchange rate to your local currency is favorable in order to maximize your money and stretch it as far as possible.

We’re big on financial independence and reaching financial goals like early retirement or paying down debt. We also talk a lot about saving more than you spend and cutting costs. Countries with cheaper costs of living like Thailand or other Southeast Asian countries, areas in Eastern Europe, or locations in South and Central America enable travel lovers to live big lifestyles while still contributing significantly to their savings. Geographic arbitrage is a perfect way to reduce your expenses as much as possible without being frugal. Sounds pretty fantastic, right?

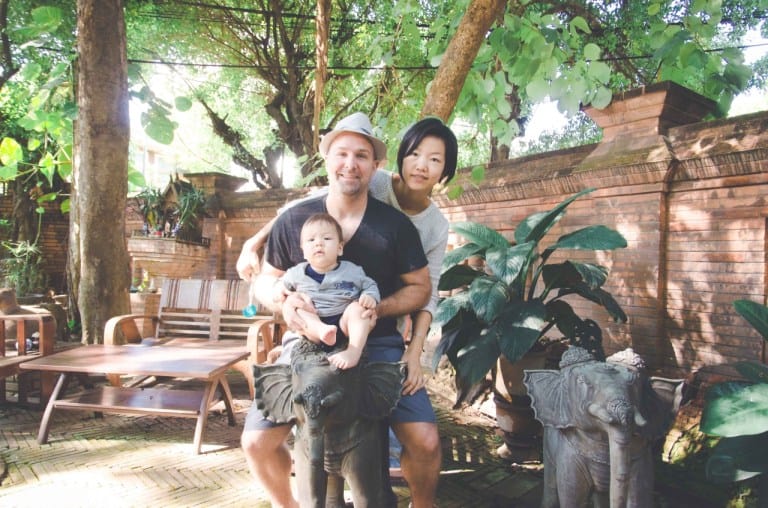

Jeremy and Winnie think so too.

Jeremy and Winnie run a personal finance blog called GoCurryCracker.com. The couple was able to retire in their 30s and become financially independent by learning how to invest, and by finding a balance between minimizing spending and maximizing their happiness and quality of life.

Jeremy and Winnie, along with their infant son Julian, moved from the United States and are currently living internationally in Chiang Mai, Thailand where they use the principle of geographic arbitrage to live a comfortable lifestyle while living off of just their portfolio. The best part is that their portfolio is continuing to grow.

How does Geographic Arbitrage work?

The significantly lower cost of living in Thailand allows them to live a lifestyle that includes a premium apartment (complete with a saltwater pool and great views of the temples) for just $375 a month, plus lots of eating out, while still technically living below their means.

A similar apartment in Los Angeles would typically cost upwards of $1,200 per month. Living in a country with a lower cost of living has those kinds of inherent savings benefits.

As Jeremy puts it:

“By basically instead of viewing yourself as, say, like a citizen of the United States, you can view yourself as a citizen of the world. The beautiful thing about this is because our portfolio can support much more, we're basically continuing to live below our means and our portfolio continues to grow. When we look out 10 years from now, our portfolio will probably at least double or probably triple. Then maybe we'll move on from there into a penthouse, living in Manhattan.”

But they’re retired!

It’s true that Jeremey and Winnie achieved early retirement in just their 30s, but if you’re thinking geographic arbitrage only works for them because they’re retired, then think again. Geographic arbitrage isn’t just for retired folks. Jeremey and Winnie achieved their early retirement by saving around 70% of their paychecks while living in the U.S.

Living frugally played a big role in allowing them to do this.

The amazing and unique thing about geographic arbitrage is that it enables you to save a much higher proportion of your income without having to compromise or make tons of spending cuts.

This is a financial concept that can work for anyone, and can actually help expedite your savings for early retirement. This can be an incredible opportunity for

anyone who loves travel and has savings goals, or who wants to achieve financial independence without having to live frugally.

If you have a job that will enable you to change locations, skills that could help you land a job in your new location, or even an online business or a business you could relocate overseas, then this is possibility for you.

(Note: Find out How To Launch A Side Business To Earn More Income And Retire Faster

Here.)

So, now that you know what geographic arbitrage is, let’s talk about what it takes to reach financial independence and retire early…and how geographic arbitrage can help.

The Math Behind Retirement

When calculating how much you’ll need for retirement you need to find the number you need saved for your investments to generate enough income to support you without working.

Generally, the formula goes:

*(With an assumed withdrawal rate of 4% [100/4 = 25])

(Note: Check out our Step By Step Plan To Early Retirement ..How This Guy Did It In 10 Years post for more on retirement metrics.)

For example, let’s say you need $40,000 per year to cover your household expenses.

Based on this formula, you’ll need $1,000,000 for a retirement plan of about 30 years. If you plan on retiring early, like Jeremy and Winnie, you’ll need your retirement plan to stretch longer than 30 years. In that case, adjust your withdrawal rate to 3.3%.

But if you're able to cut your $40,000 household expenses to, let’s say, $20,000 a year, you've halved the amount of money you need to retire and the amount of years it takes to save to get to that point. A cheaper cost of living could easily accomplish that.

Now that you know how much you’ll need to retire, let’s talk about the steps it takes to achieve financial independence.

4 Steps to Achieve Early Retirement

Step 1: Start With Zero Debt

Before you can even begin putting your savings efforts towards financial independence, you need to take care of that debt. Make it your financial priority. “When I graduated from college, I had about $40,000 in student loan and credit card debt,” Jeremy shares. “Every possible dollar went towards paying off that debt.” By focusing on paying off the high interest loans first, Jeremy was able to capitalize on his losses.

Step 2: Spend Wisely and Live Below Your Means

Jeremy and Winnie were able to put 70% of their paycheck into savings by cutting costs.

“Don't spend very much money,” Jeremy suggests.

You can live well on a middle to lower middle-class cost of living while earning something higher than that. We didn't have a car. We were a block from a grocery store, a few blocks from a library, a few blocks from a large park. Between a bicycle and our feet and low rent and taking our own kitchen as a source of amazing food, we didn't really have to spend a lot of money. Most people spend 80% of their total cost of living on housing, transportation, and food, and we spent quite little on all of those areas.

Not to beat a dead horse, but this is where geographic arbitrage is starting to look pretty appealing. What if you could save that same 70% of your paycheck without having to make cuts? When the cost of living is lower, it means your dollar goes farther and you can afford to spend on food, nice housing, and transportation for considerably less just by virtue of where you’re living.

Step 3: Save and Let Compound Interest Work in Your Favor

Investing as much as you can, will allow your money to work for you over time. Investing is a key element of saving for early retirement because it helps your money grow. Over a period of 10 to 20 years, your portfolio can start to generate more income than you actually spend. Jeremy’s asset allocation strategy included investing in index funds through Vanguard ETFs and mutual funds, which have the lowest fees, the lowest burden on your portfolio, and the most efficient tax burden.

This is really where the magic happens.

Jeremy’s advice for people who have a fear of investing:

- Many people start investing by just selecting one stock, and then when it doesn't work out, and they develop a fear of investing.

- To expose yourself to less financial risk, consider investing in mutual funds, ETFs, etc., which are collections of stocks.

- The market has cycles and stocks tend to drop every 15 or 25 years. When everybody is panicking and the market is down, you only lose if you sell.

“We can't control risk,” Jeremy muses. “We can only choose how much of it we take up.”

Step 4: Reduce Your Taxable Income

This is another step that will help you save more of what you’re earning. Utilize tax deductions from retirement planning vehicles like a 401(k) or an IRA to save money and reduce taxes. If you put the maximum amount of money into those types of accounts, you can take an immediate tax deduction. Then, all of the tax savings that you receive can be invested as well.

“As a working couple, if you're making median level US incomes or above, you can be saving 15% to 25% immediately. And then typically, you'll get 401(k) matching, employer contributions, and so you can get immediate returns from the tax and the matching of 50%+.”

Income With Preferential Tax Treatment

Some investments have preferential tax treatment, which means that all qualifying

dividends are taxed at 0% as long as you are in or below the 15% tax bracket. What that means for a married couple filing jointly, you can make about $100,000 in investment income and pay zero tax

Things To Keep In Mind:

- All other income sources; income from a job, income from interest, income from short-term gains; are taxed just like your paycheck, and you have very little control over the taxation

- Jeremy and Winnie structured their retirement income to be mostly derived from qualified dividends and long-term capital gain.

- There are annual contribution limits to a 401(k) and an IRA. You can really only save about $20k per year per person in that case, so you end up with additional savings in a standard brokerage account.

- Any withdrawals from your 401(k) in the future are considered income and are taxed at that time, but all of the dividend and gain income are be tax-free.

- As long as you have no working income, as Jeremy and Winnie had for several years, you can withdrawal from your 401(k). As long as withdrawals are small enough that your standard deductions and personal exemptions will wipe them out (about $20k a year for a married couple), you can move money from your 401(k) into a Roth IRA at 0% tax, so those gains will be tax-free forever.

How Geographic Arbitrage Can Help

We know by now that living in a lower cost area = more savings. More savings = earlier retirement.

Living in a location that has a lower cost of living, or living overseas doesn’t have to be, or even need to be, a permanent strategy. You can always view it as an opportunity or adventure that allows you to save, or allows your portfolio to grow, until you reach the point where you can afford the retirement you want, where you want. Maybe that’s overseas, maybe it’s Europe, maybe it’s stateside. Jeremy and Winnie are retired, but are allowing their portfolio to grow by living in a low-cost area overseas.

Jeremy and Winnie’s philosophy and way of thinking is that they like southeast Asia but by focusing their living and traveling around southeast Asia now and living far below the means they need to, they are able to save more, and as a result, invest more and let that investment grow more than it would be able to if they were living in a higher cost city. As their portfolio grows in the next ten years or so, they will transition to traveling and possibly living in higher cost areas because their portfolio will have grown to a point that they can afford it.

Here is a list of 15 Cool Places Where The Cost Of Living Is Significantly Lower Than In The U.S. (cost per month courtesy of nomadlist.com).

For comparison, the cost of living in some popular U.S. cities are as follows:

- Austin, Texas $3,309 per month

- Miami, Florida $4,325 per month

- Portland, Oregon $2,691 per month

- Asheville, North Carolina $2,536 per month

- New York, New York $5,646 per month

There it is, the beauty of geographic arbitrage at work. By moving to one of the 15 overseas locations above (and there are so many more), you could be spending at least 50% less than in a majority of urban U.S. locales. That’s 50% more you could be saving and investing to grow your own portfolio to reach early retirement and financial independence faster!

If you’re a travel nut, maybe it’s time to pack your bags.