Thinking of taking the plunge into homeownership but a little overwhelmed at the whole process? As if a monthly mortgage wasn’t enough, you also have to save up a significant chunk of change for your down payment. Ah, yes, the dreaded down payment. How much should you save and how should you save? That’s what this blog post is all about. Don’t let down payments give you cold feet because we interviewed a savings expert to help break down everything you need to know about saving your ideal down payment.

Jordann Brown is the blogging mastermind behind my-alternate-life.com, a blog dedicated to managing personal finances. Jordann is a savings expert who not only paid off nearly $38,000 in student loan debt within two years but has also saved up a $10,000 emergency fund. Most recently, she has saved over $30,000 for a house down payment in under a year and a half.

We’ve picked Jordann’s brain for her attack plan for calculating and saving for your ideal down payment. From deciding what percentage down payment to pay to actually saving that money, this post covers it all.

1. Make Sure You’re Ready To Buy

There’s an age-old debate over whether it’s better in the long term to rent or buy. Everyone has their preference, and buying a home is an intensely personal decision. With that said, there are certain situations in which it may make more financial sense to rent vs buy. Knowing that you’re in a financial place to buy a home is the first step.

How do I know if I should rent instead of buy?

There are 4 factors you should check off the list before buying a home. They are longevity, stability, financial security, and price-to-rent ratio.

Longevity: Is the city you plan on buying in the place you intend on staying for a while? Is there a possibility you could move soon due to career changes, family needs, relationships, or personal whims? Buying a house is like putting down roots, so if there’s a pretty good chance you could end up moving within the near future, hold off on buying.

Stability: Do you have stable employment? A mortgage is a big financial responsibility, so you want to ensure that you’ll have a stable and steady stream of income to cover the huge investment that is a house. If you haven’t achieved stable, long-term employment, or if you anticipate a possible job switch it probably makes more financial sense to continue renting.

Financial Security: Are you financially secure? Do you have significant debt? Have you built up an emergency fund? Do you have other savings? As with any large investment, having a secure financial foundation is absolutely essential. Make sure you’ve paid off debt and have saved up a sizable emergency fund before purchasing a home. If you’ve still got a ways to go before achieved a secure financial foundation, you’re not ready to buy.

If you could move soon, don’t have stable long-term employment, or aren’t financially secure, renting might be a better option for you due to its flexibility. Again, buying vs renting is absolutely a personal decision, but these benchmarks are pretty good indicators of which is right for you at this point in your life.

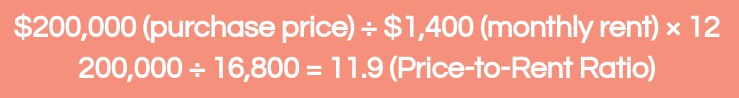

Price-to-Rent Ratio: Price-to-Rent ratio is a metric used to determine whether it is financially superior to rent or buy in a certain city or market. To determine whether it is mathematically better to rent vs buy, the price-to-rent ratio compares the cost of owning a home to the cost of renting a similar place. This is calculated by taking the total purchase price of a home (listing price) you’re looking to buy and dividing it by the annual rent of similar property.

Purchase Price ÷ (Monthly Rent of Similar Property × 12) = Price-to-Rent Ratio

According to Jordann:

“Price-to-rent ratio of 1 to 15 = much better to buy than rent

Price-to-rent ratio of 16 to 20 = typically better the rent than buy

Price-to-rent ratio of 21 or more = much better to rent than buy”

Some cities like San Francisco have outrageous price-to-rent ratios of over 40 where it is clearly better to rent vs buy. We all know San Francisco has one of the most expensive housing markets in the country, but not every city’s market is so prevalently clear, so it’s a good idea to calculate your price-to-rent ratio.

For example:

In this scenario, it is a smarter decision to buy vs rent.

So you know you’re ready to buy. Now what?

2. Choose Your Down Payment

Let’s get into the nitty gritty. A down payment is the amount of money you pay to the home’s seller directly. The rest of the payment comes from what you finance from the bank in the form of your mortgage. The higher the down payment the lower your monthly mortgage payments.

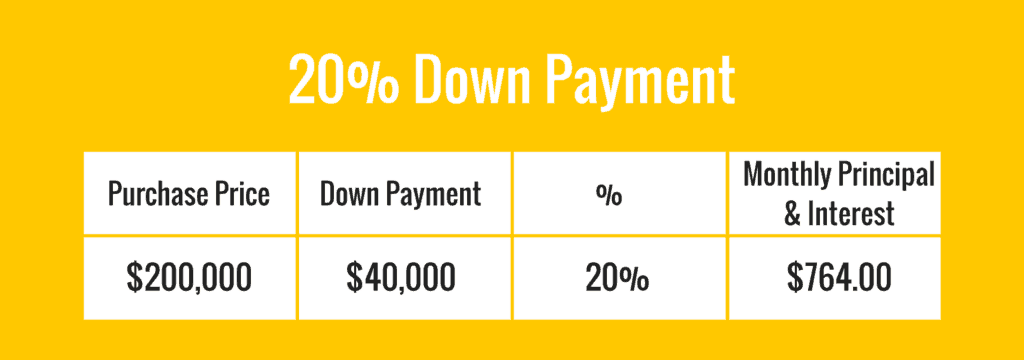

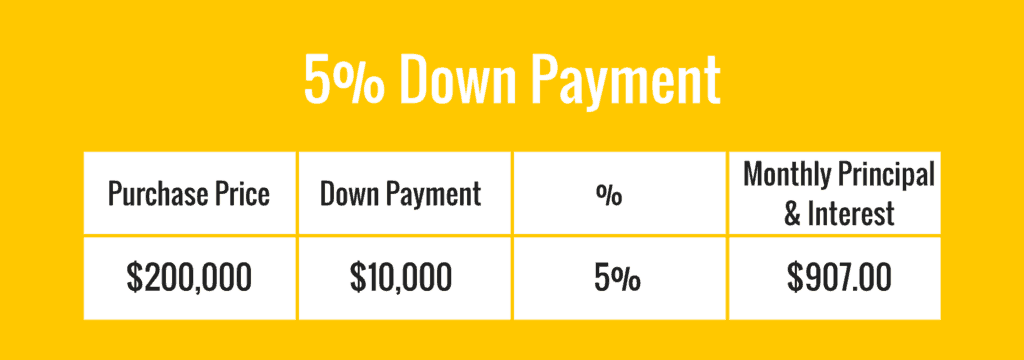

For example, let’s say you’re looking to buy a home with a purchase price of $200,000. Let’s also assume you’ve chosen a standard 30 year fixed rate mortgage with a 4% interest rate.

These are the monthly principal amounts with interest you’d pay with a 5% vs 20% down payment excluding property taxes and private mortgage insurance premiums (PMI).

Aside from this obvious correlation, higher down payments can also help you avoid taking out mortgage insurance altogether.

Common Down Payment Percentages

- The most common down payment percentages are 5%, 10%, 15% and 20%

- It is traditionally recommended that you put down 20%, though this will vary depending on the price of the home, your goals, and what you can afford. It is traditionally recommended to put 20% down because any down payment less than 20% requires you to take out mortgage insurance.

“Mortgage default insurance is basically what I call the lazy person's tax on home ownership, because it doesn't benefit you in any way. It's only there to protect the lender in case you default. It's not in case you can't make your payments, you're protected; it's they're protected in case you can't make your payment.”

Mortgage insurance gets added on as a monthly premium and it isn’t considered equity, so the less you put down, the more you pay monthly in addition to a higher mortgage payment.

What percentage should I put down?

In an ideal world, we’d all be putting down at least 20%, but the reality is, a 20% down payment isn’t realistic or ideal for every person. Take Jordann for example. Jordann originally had the goal of saving a 20% down payment, but the actual down payment percentage she went with was 10%.

How did she calculate that? Well, it was a combination of several different factors. Let’s break it down.

Calculate Your Down Payment Percentage

Ironically, calculating your down payment percentage doesn’t actually start with the down payment. It starts with your budget.

(Need help creating a budget, or just adjusting the one you have to optimize savings? Figure out how to build a budget you don’t hate here.)

- What can you afford? Look at your monthly budget. Figure out how much you can afford to spend on housing per month. Your housing costs shouldn’t account for any more than 35% max of your net monthly income. (This is cumulative: includes property taxes, insurance, and utilities)

For example, if I have a net monthly income of $3,500, I don’t want my housing costs to exceed 35% of that income. That means I can afford to spend up to $1,225 on total housing costs per month.

Again, this is not just your mortgage. Total monthly housing costs include your mortgage payment plus everything else.

You can do this manually or use an online mortgage calculator, like this one from The Mortgage Reports, to do it for you.

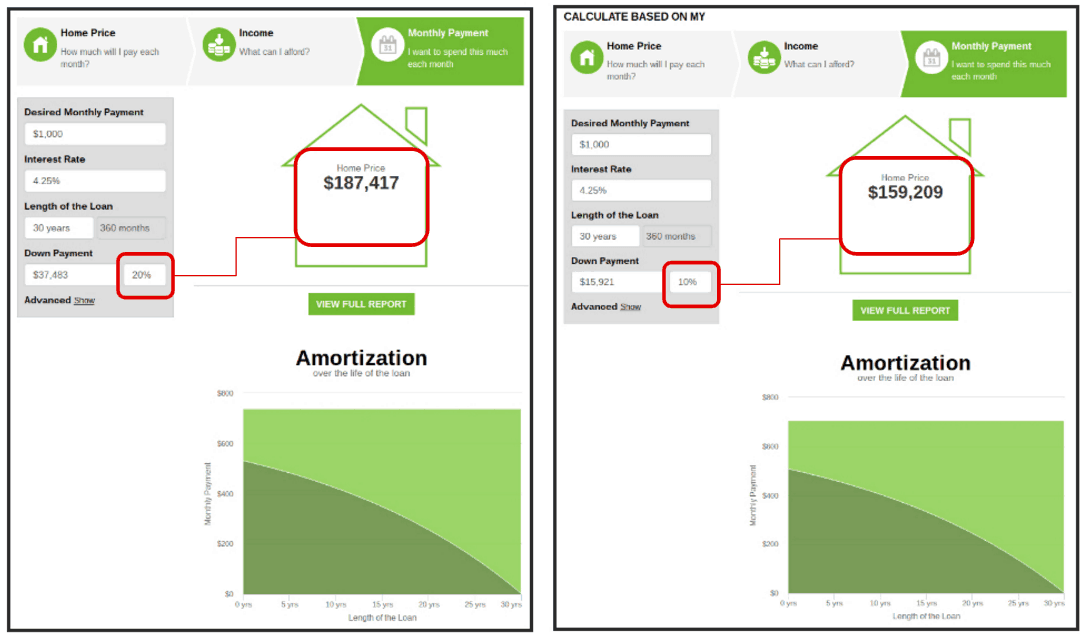

2. Using an online mortgage calculator will also calculate your maximum purchase price. You simply fill in your desired monthly payment (the mortgage payment you can afford after subtracting other housing costs like insurance and property taxes from your total housing costs). Then you can choose the length of your mortgage (20 years, 30 years, etc) with the corresponding interest rate. This will give you your maximum purchase price. You can play around with different down payment percentages to see how they affect that maximum purchase price.

If a lower down payment percentage pushes your monthly payment

above 30-35% of your net monthly income, you’ll either need to save for a larger down payment or choose a house with a lower purchase price. Again, the online mortgage calculator adjusts this for you and makes it easy to see what you can afford in every situation.

See how the calculator reduced the maximum home purchase price when the down payment was lowered from 20% to 10%. A 10% down payment on the higher priced home would have pushed the monthly payment outside of the 30-35% of net monthly income range.

After using the online mortgage calculator, you should have a pretty good idea of how much you’ll need for your down payment. That brings us to our next part.

3. Savings Timeline

What is your savings timeline?

This is absolutely a personal decision that is going to depend on your goals and income. Jordann’s own situation is a perfect example of this. Her initial goal was to save up about $40,000 for a 20% down payment. Instead, she saved up $33,000 and then went with a 10% down payment. Why?

“My original goal was $40,000 to buy a house, costing me around $315,000. Based on my math, I knew that that would work out where I could afford that and it would work with my monthly budget, so I could still save. The reason I didn't get to that amount was because I ended up buying a home for $270,000, so I didn't need that full $40,000. I was still able to make a 10% down payment and have enough left over for closing costs and still make my monthly budget align, so that's sort of how that all worked.”

Where do those savings come from?

Jordann saved up $33,000 in just a year in a half. She had an aggressive savings plan paired with her and her husband’s combined yearly income of around $100,000. Jordann and her husband put around $1,000 per month towards their down payment savings in addition to all of Jordann’s freelance income (25-50% of her gross income).

Prioritize: Prioritize your down payment as your primary financial goal. Just as if you were putting money towards eliminating debt, really throw your savings efforts behind funding your down payment. Be consistent and budget to make monthly contributions.

Create a Timeline: Find out how much you’ll put down in a year with those consistent monthly contributions. This gives you an estimate of how many years it will take to save up the full amount. Watching your goal creep closer to the finish line will keep you motivated.

Should your savings plan be as aggressive as Jordann’s? Well, that all depends on your goals.

Ask yourself:

- How much do I need to save?

- What is my monthly and yearly income?

- How quickly do I want to save that amount? When do you want to be in your home? How much you’ll need to contribute to savings monthly will directly relate to how quickly you want to achieve your savings goal. Monthly contributions for 3 years will look a lot different than monthly contributions for a year and a half.

- How quickly can I reasonably save that amount? How much can you contribute monthly realistically for your lifestyle based on your income? What level of frugality are you comfortable with? Is saving $1,000 a month going to put too much strain on your basic functioning?

- Am I an experienced saver? Jordann is a very experienced saver. She knows how frugal she can get and where to make cuts, so having an aggressive savings plan is something she can plan for. A less experienced saver might be better off with a slower savings plan. Jordann also was in a place of complete financial stability. Her year and half timeline seems very fast, but prior she paid off all debt, built up a $10k emergency fund and makes regular retirement contributions. It took her years to reach financial stability. If you’re already there, that’s great. If you’re not and you need to put savings toward eliminating debt while saving for your down payment, factor in a longer timeline.

If you want to be more aggressive, see if you can contribute more each month by cutting down in other areas or by picking up a side hustle (like Jordann’s freelancing).

Where Do I Keep These Savings?

When should you use a savings account versus an investment account to store your down payment savings?

Savings Account: If you plan on being in your house within the next 5 years, go with a savings account. It’s less risky than an investment account. 5 years might not be long enough for your money to recover in case of a market crash.

Investment Account: If you plan on saving for longer than 5 years, go with an investment account (or at least invest a portion) and let your money work for you. Why? If your purchase goal is longer term, your money will likely have time to recover.

4. Be Flexible

This is why using the online mortgage calculator is so beneficial and important. Jordann knew what she could afford monthly according to different down payment percentages in relation to the purchase price of a home. By purchasing a less expensive home with 10% down she’s only paying $4,000 in mortgage default insurance and $100 more per month than she would have under her original goal, which as she says, still works within her budget.

Reasons Jordann purchased a home outside of her goal:

- It fit in with her budget (which is an obvious must)

- The trade off of paying an extra $100 per month plus her mortgage insurance in exchange for not having to wait an additional couple of years to save up a full 20% down payment was justifiable enough, and her monthly payments are still affordable.

- The right house came along earlier than expected. Jordann saw the home that fit both her and her husband's priorities. It was still affordable with a lower down payment, so she was able to be flexible and purchase ahead of her goal.

If the perfect home comes along that also happens to work within your budget, having the flexibility to adjust your goal will be important. Jordann didn’t want to wait another couple of years to buy a home, so she purchased a home that worked with her current savings and budget.

Goals will change. Staying consistent but flexible allows you to make the most out of your savings and will further help you save for your ideal down payment even if that amount changes.

There you have it. Remember to make sure it’s actually a better financial decision to buy versus rent, then plan for your monthly housing costs to stay below 30-35% of your net monthly income, use an online mortgage calculator to find your maximum purchase price based on your income and play around with different down payment percentages to see what you can afford in every different situation.

Consider differences in home equity, mortgage insurance rates, and monthly mortgage costs based on those different down payment percentages in order to find the one that is ideal for you. Make a timeline based on how quickly you want to purchase your home and how much you can afford to save monthly, and then make consistent monthly contributions based on that timeline in order to hit your savings goal. Use metrics, stay consistent, be flexible, and start saving up for your ideal down payment.